Introduction

Cloud computing has fundamentally redefined how enterprises consume technology resources. Instead of large, predictable capital expenditures tied to physical infrastructure investments, finance teams now manage highly dynamic operating expenses across cloud services and Software-as-a-Service (SaaS) subscriptions. This transformation offers unprecedented agility and scalability, but it also creates significant financial reporting risks that many organizations are still learning to navigate.

When financial reporting relies on volatile, usage-based charges and dozens of automatically renewing contracts, the stakes for accuracy grow exponentially higher. A single misconfigured cloud resource can generate thousands of dollars in unexpected charges overnight, while shadow IT purchases can accumulate into material expenses that bypass traditional approval workflows entirely.

At the same time, U.S. companies face stringent regulatory demands under the Sarbanes-Oxley Act (SOX). Passed in 2002 in response to high-profile financial scandals like Enron and WorldCom, SOX requires public companies to maintain robust internal controls, ensure the accuracy of financial statements, and disclose material changes promptly. What once applied primarily to traditional finance and accounting processes now extends to digital infrastructure, SaaS portfolios, and cloud platforms that can represent 20-30% of total IT budgets in modern enterprises.

Cloud cost transparency, therefore, is no longer just an efficiency or FinOps discipline—it is a fundamental compliance requirement. If executives cannot certify that financial statements fully and accurately capture cloud spending, they risk violating SOX regulations and facing severe penalties. If auditors cannot trace cloud invoices to budgets and approvals, control deficiencies may be reported, potentially triggering expensive remediation efforts. And if material cost changes go undetected until quarter-end, Section 409 disclosure obligations could be breached, leading to regulatory investigations and investor confidence issues.

This article explores how SOX intersects with cloud financial management, why transparency is essential for compliance, and how organizations can build robust, audit-ready processes for the modern digital economy.

SOX Requirements Through the Lens of Cloud Computing

Section 302: Executive Accountability in the Cloud Era

Section 302 requires that CEOs and CFOs personally certify the accuracy of financial reports filed with the Securities and Exchange Commission. This certification includes not only revenues but also expenses—among them increasingly significant cloud and SaaS costs that can fluctuate dramatically from month to month.

When invoices are fragmented across multiple cloud providers, each with different billing cycles and pricing models, or when SaaS renewals happen without financial oversight through decentralized procurement processes, executives cannot confidently certify that reported expenses are complete and accurate. The risk is compounded by the fact that cloud costs often involve complex pricing structures, including reserved instances, spot pricing, and usage tiers that can make invoice reconciliation extremely challenging.

A compelling case in point involves a publicly traded software company that disclosed a material weakness after discovering that engineering teams had purchased SaaS security tools using corporate credit cards over an 18-month period. The costs, though small individually (typically $50-200 per month per tool), aggregated into millions of dollars that were never routed through proper procurement channels or allocated correctly in the general ledger. The expenses were buried in miscellaneous credit card statements rather than being categorized as software licensing costs, creating a systematic misclassification that persisted across multiple reporting periods.

Auditors flagged the lack of visibility as a fundamental failure of internal control over financial reporting, noting that management had no systematic way to identify, approve, or track these recurring expenses. The remediation required extensive manual work to identify all unauthorized subscriptions, validate their business purpose, and implement new controls to prevent similar occurrences. Cloud cost transparency platforms prevent this scenario by aggregating all subscriptions across payment methods and linking them to pre-approved budgets in real time.

Section 404: Internal Controls for Cloud Infrastructure

Section 404 requires companies to design, implement, and test effective internal controls over financial reporting (ICFR). In the cloud context, this translates to establishing comprehensive governance frameworks that address the unique characteristics of cloud consumption.

Effective cloud financial controls must address several key areas. First, organizations need clearly defined approval processes for new cloud accounts and SaaS contracts that integrate with existing procurement workflows. This includes establishing spending limits, requiring business justification, and ensuring proper budget allocation before resources can be provisioned.

Second, cost-allocation tags must be consistently applied across all cloud resources to ensure proper expense attribution. This requirement becomes particularly challenging in multi-cloud environments where different providers have varying tagging capabilities and naming conventions.

Third, regular reconciliation processes must validate that cloud invoices accurately reflect actual usage and align with budget expectations. This involves comparing provider invoices against internal usage reports and investigating any significant variances.

Finally, organizations must maintain comprehensive audit trails of all approvals, configuration changes, and cost anomalies to support their internal control assertions during SOX audits.

When organizations fail to implement these controls effectively, they often face significant audit adjustments and delays in financial reporting. For example, a financial services firm discovered during its annual SOX audit that nearly 25% of its cloud resources across AWS, Azure, and Google Cloud Platform were untagged, leaving millions of dollars of expenses unattributed to specific business units or projects. The auditors required extensive manual reconciliation work to trace these costs back to their sources, involving hundreds of hours of work from both internal teams and external consultants, ultimately delaying the filing of quarterly reports by several weeks.

The importance of establishing clear financial governance frameworks is reinforced by Binadox’s insights on cost transparency in business, which emphasizes that financial clarity serves as the foundation of effective governance and regulatory compliance.

Section 409: Timely Disclosure of Material Changes

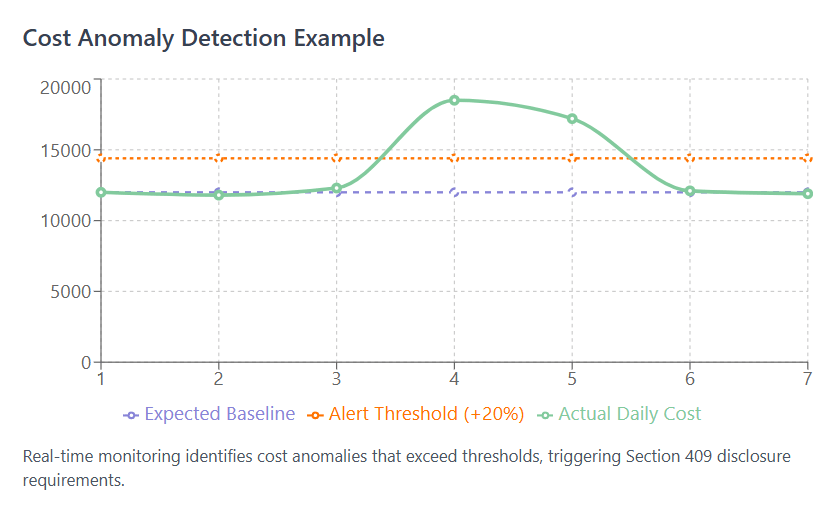

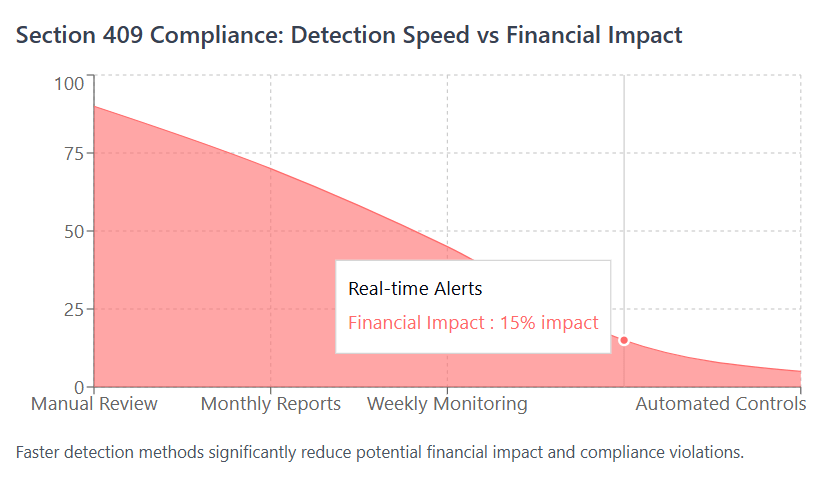

Section 409 requires that companies disclose material changes in their financial condition “on a rapid and current basis.” For cloud and SaaS expenses, this means detecting cost anomalies as they happen, not weeks later during the monthly financial close process when it may be too late to take corrective action.

Consider a real-world scenario where a cloud migration project encountered technical difficulties, causing applications to consume significantly more compute resources than anticipated. The resulting overages doubled the company’s monthly cloud bill from $500,000 to over $1 million. If this change is significant enough to materially affect quarterly financial performance—which a $500,000 monthly increase certainly would be for most companies—Section 409 obligates prompt disclosure to investors and regulators.

Without real-time cost monitoring and anomaly detection capabilities, companies may not discover such changes until they receive their monthly cloud bills, potentially weeks after the cost spike began. This delay could constitute a violation of Section 409’s “rapid and current basis” requirement, especially if the company had sufficient systems in place to detect the change earlier.

Platforms that include sophisticated anomaly detection algorithms and real-time cost explorers provide the early warning systems needed to fulfill Section 409 obligations. These systems can identify unusual spending patterns within hours rather than weeks, enabling companies to investigate, remediate, and disclose as required.

As discussed in comprehensive Cloud Financial Management frameworks, timely access to accurate cost data transforms reactive cost tracking into a proactive compliance safeguard that protects both financial performance and regulatory standing.

Technical Implementation of Compliance Controls

Implementing SOX-compliant cloud cost management requires robust technical infrastructure that can handle the complexity and scale of modern cloud environments. Here’s an example of how organizations might structure automated cost monitoring and alerting systems:

python

import boto3

import json

from datetime import datetime, timedelta

class CloudCostMonitor:

def __init__(self, aws_account_id, alert_threshold=0.20):

self.aws_account_id = aws_account_id

self.alert_threshold = alert_threshold # 20% increase threshold

self.cost_explorer = boto3.client('ce')

def get_daily_costs(self, days_back=7):

"""Retrieve daily costs for anomaly detection"""

end_date = datetime.now().strftime('%Y-%m-%d')

start_date = (datetime.now() - timedelta(days=days_back)).strftime('%Y-%m-%d')

response = self.cost_explorer.get_cost_and_usage(

TimePeriod={

'Start': start_date,

'End': end_date

},

Granularity='DAILY',

Metrics=['BlendedCost'],

GroupBy=[

{'Type': 'DIMENSION', 'Key': 'SERVICE'}

]

)

return response['ResultsByTime']

def detect_anomalies(self):

"""Detect cost anomalies for SOX 409 compliance"""

daily_costs = self.get_daily_costs()

for day_data in daily_costs[-2:]: # Check last 2 days

current_cost = float(day_data['Total']['BlendedCost']['Amount'])

# Compare against 7-day average

historical_avg = self.calculate_historical_average(daily_costs[:-2])

if current_cost > historical_avg * (1 + self.alert_threshold):

self.trigger_sox_alert(day_data, current_cost, historical_avg)

def trigger_sox_alert(self, day_data, current_cost, baseline):

"""Generate compliance alert for material cost changes"""

variance_percent = ((current_cost - baseline) / baseline) * 100

alert = {

'timestamp': datetime.now().isoformat(),

'account_id': self.aws_account_id,

'date': day_data['TimePeriod']['Start'],

'current_cost': current_cost,

'baseline_cost': baseline,

'variance_percent': variance_percent,

'materiality_assessment': 'REVIEW_REQUIRED',

'sox_section': '409 - Timely Disclosure'

}

# Send to compliance team and log for audit trail

self.send_compliance_notification(alert)

self.log_audit_event(alert)This technical approach demonstrates how organizations can build automated systems that not only monitor costs but also create the audit trails required for SOX compliance. The system maintains detailed logs of all cost anomalies, threshold breaches, and notification actions, providing auditors with clear evidence of control effectiveness.

Why Cloud and SaaS Costs Present Unique Compliance Risks

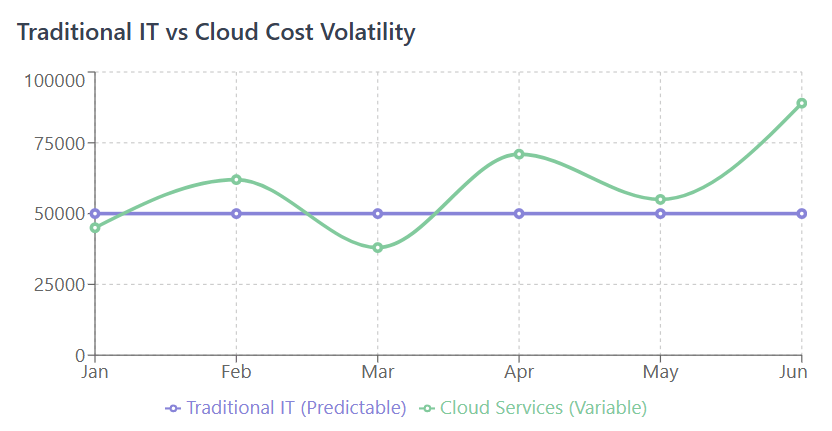

Traditional IT spending followed predictable patterns that aligned well with established financial controls. Servers and software licenses were typically purchased through formal procurement processes, recorded as capital expenditures, and depreciated over multi-year periods according to standard accounting principles. This model provided finance teams with clear visibility into technology investments and their financial impact.

Cloud and SaaS consumption models fundamentally disrupt this paradigm in ways that create significant compliance challenges. Modern cloud costs are highly variable, fluctuating daily or even hourly based on actual usage patterns that can be influenced by factors as diverse as application load, development activity, data processing jobs, and even external events like traffic spikes or security incidents.

The decentralized nature of cloud procurement compounds these risks. While traditional IT purchases typically flowed through centralized procurement teams with established approval workflows, cloud resources can often be provisioned instantly by individual developers or business users. A data scientist can spin up a powerful GPU instance for machine learning experiments, a marketing team can subscribe to new analytics platforms, or a development team can deploy additional microservices—all without traditional procurement oversight.

Multi-cloud environments further fragment financial visibility by scattering invoices across AWS, Microsoft Azure, Google Cloud Platform, and dozens of smaller specialized providers. Each provider has different billing cycles, pricing models, invoice formats, and account structures, making consolidated financial reporting extremely challenging without sophisticated aggregation tools.

The recurring nature of SaaS contracts creates additional compliance risks through automatic renewals that can lock organizations into significant financial commitments without fresh approvals or budget validation. A $10,000 monthly software subscription that auto-renews annually represents a $120,000 commitment that may never receive appropriate financial review if it’s buried among hundreds of other recurring charges.

Perhaps most problematically, cloud billing structures are often opaque and difficult to interpret without specialized knowledge. Reserved instances, spot pricing, committed use discounts, and complex tiered pricing models can make it nearly impossible for finance teams to validate that bills accurately reflect actual consumption. As the Binadox article on showback vs chargeback explains, without proper cost allocation mechanisms, organizations lose fundamental accountability for understanding who is driving costs and why, creating fertile ground for compliance failures.

Building a Comprehensive Compliance-Ready Framework

Implementing Centralized Financial Visibility

The foundation of SOX-compliant cloud cost management is establishing a single source of truth for all technology spending. This requires sophisticated data integration capabilities that can aggregate invoices, usage reports, and contract information from dozens of different sources into a unified financial view.

A compliance-ready platform must ingest billing data from major cloud providers like AWS, Azure, and Google Cloud, while also capturing SaaS subscriptions managed through various payment methods including corporate credit cards, direct vendor relationships, and third-party marketplaces. The system should normalize this disparate data into consistent formats that align with the organization’s chart of accounts and financial reporting requirements.

Real-time data integration is crucial for meeting SOX disclosure obligations. Rather than relying on monthly invoice reconciliation, the system should capture usage and cost data continuously, enabling finance teams to identify material changes within hours rather than weeks. This capability is essential for fulfilling Section 409 requirements for timely disclosure of material financial changes.

Advanced Tagging and Attribution Strategies

SOX compliance demands clear accountability for all expenses, which in the cloud context translates to comprehensive resource tagging and cost attribution. A robust tagging strategy must address multiple dimensions of financial responsibility, including business unit ownership, project allocation, environment classification (production, development, testing), and cost center assignment.

Organizations should implement automated tagging policies that enforce consistent attribution at the point of resource creation. Here’s an example of how this might be structured using cloud-native policy enforcement:

json

{

"Version": "2012-10-17",

"Statement": [

{

"Sid": "RequireComplianceTags",

"Effect": "Deny",

"Action": [

"ec2:RunInstances",

"rds:CreateDBInstance",

"s3:CreateBucket"

],

"Resource": "*",

"Condition": {

"Null": {

"aws:RequestedRegion": "false"

},

"ForAllValues:StringLike": {

"aws:RequestTag/CostCenter": "",

"aws:RequestTag/Project": "",

"aws:RequestTag/Environment": "",

"aws:RequestTag/Owner": ""

}

}

}

]

}This policy prevents users from creating cloud resources without proper cost allocation tags, ensuring that all spending can be attributed to specific budget categories for financial reporting purposes. The automation eliminates human error and ensures consistent compliance with organizational tagging standards.

Sophisticated Renewal Governance and Contract Management

SaaS contract management presents unique challenges for SOX compliance because subscription agreements often involve automatic renewals that can commit organizations to significant future expenses without appropriate financial oversight. A compliance-ready approach requires proactive governance of the entire subscription lifecycle.

Organizations should maintain comprehensive renewal calendars that provide finance teams with advance visibility into upcoming contract decisions. These systems should integrate with procurement workflows to ensure that renewal decisions receive appropriate business justification, budget validation, and executive approval before commitments are made.

The importance of proactive governance echoes in Binadox’s 10 proven strategies for reducing IT costs, where controlled renewal practices are identified as both a leading cost-optimization technique and a fundamental compliance safeguard.

Contract management systems should also track key financial terms including pricing escalation clauses, usage-based billing thresholds, and termination requirements. This information is crucial for accurate financial forecasting and ensuring that contract commitments are properly reflected in financial statements.

Real-Time Anomaly Detection and Investigation Workflows

Section 409 compliance requires organizations to detect and disclose material financial changes on a “rapid and current basis.” In the context of volatile cloud costs, this necessitates sophisticated anomaly detection capabilities that can identify unusual spending patterns within hours of their occurrence.

Effective anomaly detection systems must account for normal usage patterns, seasonal variations, and planned changes like product launches or marketing campaigns that might legitimately drive cost increases. Machine learning algorithms can establish baseline spending patterns and identify deviations that warrant investigation.

When anomalies are detected, automated workflows should immediately notify appropriate stakeholders including finance teams, IT management, and compliance officers. The system should also initiate investigation procedures that document the cause of cost changes and assess their materiality for disclosure purposes.

Comprehensive Audit Trail Management

Every SOX audit requires extensive documentation demonstrating the effectiveness of internal controls over financial reporting. Cloud cost management systems must therefore maintain immutable audit trails that capture all significant events including resource provisioning decisions, cost allocation changes, approval workflows, and exception handling.

These audit trails must be tamper-proof and provide clear chronological records of all financial transactions and control activities. The documentation should be sufficient to enable auditors to trace any expense from its source through final financial statement presentation, validating that appropriate controls were operating effectively throughout the process.

Extended Real-World Implementation Case Study

A comprehensive example demonstrates how these principles work in practice. A U.S.-based healthcare SaaS provider with over $100 million in annual revenue faced recurring SOX audit deficiencies specifically tied to its cloud infrastructure costs, which represented approximately 15% of total operating expenses.

The company’s problems stemmed from multiple control weaknesses. Engineering teams were provisioning AWS test environments without proper tagging, making it impossible to attribute costs to specific projects or business units. The marketing organization had independently signed contracts with multiple SaaS analytics platforms without involving procurement or finance teams. Development operations teams were using spot instances and reserved capacity without proper financial modeling or approval processes.

During the company’s annual SOX 404 assessment, auditors identified material weaknesses in internal controls over financial reporting, specifically noting the lack of systematic controls over cloud and SaaS spending. The audit findings required immediate remediation and triggered additional testing in subsequent quarters.

The company’s remediation effort involved implementing a comprehensive cloud cost transparency platform that provided complete visibility into spending across all cloud providers and SaaS vendors. The solution included automated tagging enforcement that achieved compliance rates above 95%, eliminating the attribution problems that had plagued previous audits.

Renewal oversight capabilities eliminated unauthorized SaaS contracts by requiring finance approval for all subscription decisions above specified thresholds. The platform integrated with the company’s existing procurement workflows, ensuring that all technology spending followed established approval processes.

Automated anomaly detection systems provided real-time alerts when spending exceeded predetermined thresholds, enabling the finance team to investigate and document cost changes immediately rather than discovering them weeks later during monthly close processes. These capabilities proved crucial for meeting Section 409 disclosure requirements during several incidents including a database migration that temporarily doubled storage costs and a marketing campaign that drove unexpected data processing charges.

In the subsequent SOX audit, the company not only avoided control deficiencies but also demonstrated significant improvements in financial close efficiency. The enhanced visibility and automated controls shortened the monthly close cycle by 30%, proving that compliance investments can generate operational benefits beyond regulatory requirements.

The Evolving Future of SOX Compliance in Cloud-Native Organizations

As cloud adoption continues to accelerate and organizations become increasingly cloud-native, regulatory expectations and audit requirements will inevitably evolve to address new technological realities. Several emerging trends are already shaping the future landscape of compliance.

Artificial intelligence and machine learning capabilities will enable more sophisticated financial forecasting and anomaly detection. Predictive models will help finance teams anticipate material cost changes before they occur, transforming compliance from a reactive process into a proactive strategic capability. These systems will be able to identify subtle patterns that indicate impending cost increases, such as gradual increases in storage utilization that suggest upcoming data growth or changes in application usage patterns that typically precede infrastructure scaling.

Auditors are beginning to scrutinize SaaS portfolios more closely as these expenses represent increasingly significant portions of total IT budgets. This heightened focus will drive stricter requirements for renewal governance, license usage optimization, and shadow IT prevention. Organizations will need more sophisticated tools for discovering and managing the complete SaaS landscape, including applications purchased through individual credit cards, departmental budgets, and third-party marketplaces.

Environmental, social, and governance (ESG) reporting requirements are beginning to intersect with cloud cost management as regulators and investors demand greater transparency into sustainability impacts. Cloud cost transparency, particularly in relation to carbon emissions from compute workloads, will increasingly overlap with ESG compliance requirements. Organizations will need to track not only the financial costs of cloud consumption but also their environmental impacts, requiring new dimensions of reporting and control.

Multi-cloud complexity will continue to grow as organizations adopt best-of-breed solutions across multiple providers rather than standardizing on single platforms. This trend will require companies to demonstrate consistent internal controls across all cloud platforms, not just their primary provider. The compliance burden will increase as organizations must maintain equivalent control frameworks across AWS, Azure, Google Cloud, and numerous smaller specialized providers.

FinOps teams and compliance officers will work together more closely, embedding SOX control requirements directly into cloud financial operations rather than treating compliance as a separate quarterly exercise. This integration will drive the development of new tools and processes that make compliance activities continuous rather than periodic.

Binadox has already noted the critical importance of optimization in managing excess capacity to optimize variable expense ratios, where operational efficiency translates directly into compliance-ready cost management. Similarly, their guidance on demystifying Google Cloud billing reinforces the need for interpretable invoices and transparent cost structures—capabilities that auditors consistently demand and that will become increasingly important as cloud spending grows.

The intersection of SOX compliance and SaaS economics will become even more pronounced as subscription models dominate software consumption. As the Binadox article on key financial metrics for SaaS points out, measuring SaaS financial health is both a business imperative and a compliance necessity, since subscription revenue and expense recognition must be accurate and complete for financial reporting purposes.

Conclusion

SOX compliance and cloud cost management have evolved from parallel disciplines into fundamentally intertwined business requirements. Modern executives must certify financial statements that increasingly include large, volatile cloud and SaaS costs that can change rapidly based on usage patterns, business growth, and technical decisions made throughout the organization. Auditors must test internal controls over expenses that are decentralized, dynamic, and often opaque without specialized tools and expertise.

Companies operating in this environment must be able to detect and disclose material changes in real time, maintain comprehensive audit trails of all technology spending decisions, and demonstrate effective controls over increasingly complex cloud consumption patterns. The stakes for getting this right are significant: SOX violations can result in substantial penalties, executive liability, and loss of investor confidence.

The solution lies in comprehensive cloud cost transparency that encompasses centralized visibility across all technology spending, sophisticated tagging and attribution capabilities, proactive renewal governance, real-time anomaly detection, and immutable audit trails. These capabilities not only reduce waste and improve financial efficiency but also provide the evidence and documentation that auditors demand for SOX compliance.

As Binadox’s extensive resources on cloud financial management and related practices consistently emphasize, organizations that embrace transparency gain both compliance assurance and competitive advantage. In today’s regulatory environment, transparency is not merely a best practice—it is a compliance requirement, an efficiency driver, and a strategic capability that enables organizations to confidently navigate the complex intersection of cloud technology and financial regulation.

The organizations that succeed in this environment will be those that recognize cloud cost transparency as a fundamental business capability rather than a technical nice-to-have, investing in the tools, processes, and expertise needed to maintain both operational excellence and regulatory compliance in an increasingly cloud-centric world.