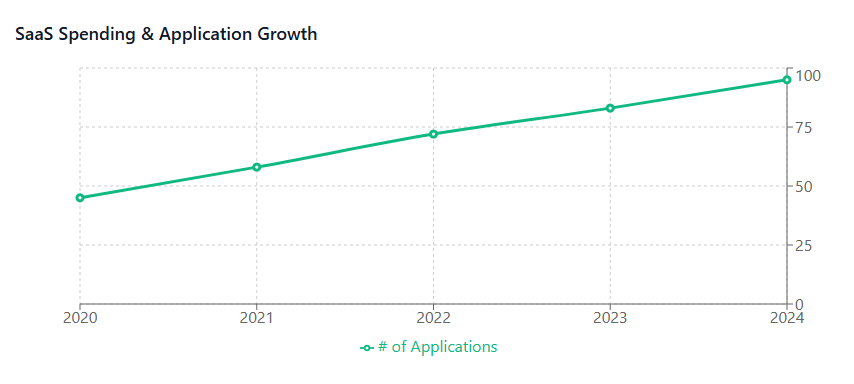

In today’s digital landscape, Software as a Service (SaaS) applications have become the backbone of modern business operations. Organizations now rely on an average of 80+ SaaS applications, making app budget management a critical component of financial operations. However, with this proliferation comes the challenge of managing costs, preventing waste, and ensuring optimal value from software investments.

Building a Financial Operations (FinOps) culture around SaaS spend isn’t just about cutting costs—it’s about creating a sustainable framework that enables cost-effective SaaS tools usage while maintaining operational efficiency. This comprehensive approach requires collaboration between finance, IT, and business teams to establish accountability, visibility, and continuous optimization of software subscriptions.

As organizations embrace automated SaaS tracking and implement sophisticated SaaS cost optimization strategies, the need for a structured FinOps culture becomes increasingly apparent. This article explores the essential components of building such a culture, providing actionable insights and proven methodologies to transform how your organization manages SaaS spending.

Understanding FinOps in the SaaS Context

Financial Operations (FinOps) represents a cultural shift that brings financial accountability to the variable spend model of cloud and SaaS services. Unlike traditional IT spending, where costs were predictable and largely fixed, SaaS spending is dynamic, distributed, and often managed by individual departments or teams.

The core principles of FinOps applied to SaaS spending include:

Collaboration and Accountability: Creating cross-functional teams that include finance, IT, procurement, and business unit leaders to make informed decisions about software investments. This collaborative approach ensures that centralized app management strategies align with both financial constraints and operational requirements.

Real-time Decision Making: Implementing systems that provide immediate visibility into SaaS usage patterns, costs, and trends. This enables organizations to make data-driven decisions about renewals, upgrades, or cancellations before they impact the budget.

Continuous Optimization: Establishing processes for regular review and optimization of the SaaS portfolio. This includes identifying underutilized licenses, duplicate applications, and opportunities for consolidation or renegotiation.

Business Value Focus: Shifting from a pure cost-cutting mentality to one that optimizes for business value. This means considering factors like productivity gains, user satisfaction, and strategic alignment when making SaaS investment decisions.

The FinOps in Cloud Computing methodology provides a foundation that can be adapted specifically for SaaS environments, where the challenges are unique but the principles remain consistent.

The Current State of SaaS Spending Challenges

Organizations today face unprecedented challenges in managing their SaaS portfolios. The rapid adoption of cloud-based solutions, accelerated by remote work trends, has led to what many IT leaders describe as “SaaS sprawl”—the uncontrolled proliferation of software subscriptions across departments.

Visibility Gaps: Many organizations lack comprehensive visibility into their complete SaaS portfolio. Shadow IT purchases, individual subscriptions paid through personal credit cards, and departmental software acquisitions often fly under the radar of centralized IT management. This lack of visibility makes it impossible to implement effective subscription cost management strategies.

Cost Escalation: SaaS costs tend to increase over time through a combination of factors: user growth, feature upgrades, automatic renewals at higher rates, and the accumulation of unused licenses. Without proper governance, organizations can see their software spending increase by 20-30% annually without corresponding business value.

Redundancy and Overlap: Different departments often purchase similar solutions independently, leading to functional overlap and wasted spending. For example, marketing might subscribe to one video conferencing tool while sales uses another, and IT maintains an enterprise solution for the entire organization.

Compliance and Security Risks: Unmanaged SaaS adoption can introduce security vulnerabilities and compliance issues. Applications that aren’t properly vetted or integrated with identity management systems create potential data breaches and regulatory violations.

These challenges highlight the critical need for affordable SaaS solutions strategies that don’t compromise on functionality or security while maintaining financial discipline.

Building the Foundation: Key Components of a SaaS FinOps Culture

1. Establishing Governance Frameworks

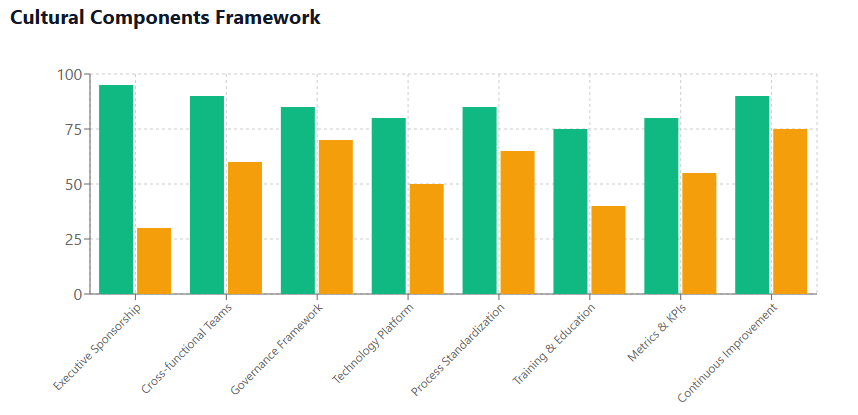

The foundation of any successful SaaS FinOps culture is a robust governance framework that defines policies, procedures, and accountability structures. This framework should address several key areas:

Procurement Policies: Develop clear policies that define who can purchase SaaS applications, what approval processes are required, and how new software requests should be evaluated. These policies should balance the need for agility with the requirement for financial control and security compliance.

Budget Allocation and Ownership: Clearly define budget ownership for different categories of SaaS applications. Some organizations allocate SaaS budgets to individual departments, while others maintain centralized control. The key is establishing clear accountability and ensuring that budget owners understand their responsibilities.

Usage Monitoring and Reporting: Implement systems and processes for regular monitoring of SaaS usage and costs. This includes defining key performance indicators (KPIs) such as cost per user, utilization rates, and return on investment metrics.

Renewal and Vendor Management: Establish standardized processes for managing vendor relationships, contract negotiations, and renewal decisions. This includes maintaining a centralized calendar of renewal dates and implementing review processes well in advance of contract expirations.

2. Creating Cross-Functional Teams

Successful SaaS FinOps requires collaboration between multiple organizational functions. Creating dedicated cross-functional teams ensures that decisions consider all relevant perspectives:

The SaaS Center of Excellence: Establish a dedicated team responsible for SaaS strategy, governance, and optimization. This team typically includes representatives from IT, finance, procurement, and security, with rotating participation from business unit leaders.

Business Unit SaaS Champions: Identify champions within each business unit who understand both the functional requirements and the financial implications of SaaS decisions. These individuals serve as bridges between the central governance team and departmental needs.

Executive Sponsorship: Ensure executive-level sponsorship for SaaS FinOps initiatives. This sponsorship is crucial for driving cultural change and ensuring that cost optimization efforts don’t undermine business objectives.

3. Implementing Technology Solutions

While culture and process are fundamental, technology solutions are essential for scaling SaaS FinOps practices across large organizations:

SaaS Management Platforms: Implement comprehensive platforms that provide visibility into the entire SaaS portfolio, usage patterns, and cost trends. These platforms should offer features like automated discovery, usage tracking, and cost optimization recommendations.

Integration with Financial Systems: Ensure that SaaS management tools integrate with existing financial and procurement systems to provide comprehensive reporting and streamline approval workflows.

Automation Capabilities: Leverage automation for routine tasks like license provisioning, deprovisioning, and usage monitoring. Automation reduces administrative overhead and ensures consistent application of governance policies.

The How To Optimize Microsoft Office 365 Deployment and Cost guide provides practical examples of how technology solutions can optimize specific SaaS investments.

Establishing SaaS Spend Visibility and Tracking

Visibility is the cornerstone of effective SaaS spend management. Organizations cannot optimize what they cannot see, making comprehensive tracking and monitoring essential for successful FinOps implementation.

Comprehensive Discovery and Inventory

The first step in establishing visibility is conducting a comprehensive discovery of all SaaS applications within the organization. This process should include:

Automated Discovery Tools: Deploy tools that can automatically identify SaaS applications through network traffic analysis, DNS monitoring, and integration with identity providers. These tools can uncover shadow IT applications that might not appear in centralized procurement records.

Financial System Analysis: Review credit card statements, accounts payable records, and expense reports to identify SaaS subscriptions that might have been purchased outside of standard procurement channels.

Department-by-Department Audits: Conduct structured interviews with department heads and key users to identify applications that might not be captured through automated discovery methods.

Vendor and Contract Reviews: Compile a complete list of software vendors and review all active contracts to ensure nothing is missed in the inventory process.

Implementing Usage Monitoring

Once all applications are identified, implementing robust usage monitoring becomes critical:

User Activity Tracking: Monitor actual user engagement with SaaS applications, including login frequency, feature utilization, and time spent within applications. This data helps identify underutilized licenses and opportunities for optimization.

License Utilization Analysis: Track the ratio of purchased licenses to active users, identifying opportunities to reduce subscriptions or reallocate licenses between departments or user groups.

Feature Usage Assessment: Many SaaS applications offer multiple tiers with different feature sets. Monitoring which features are actually used helps organizations optimize their subscription levels and avoid paying for unused capabilities.

Cost per User Analysis: Calculate the actual cost per active user for each application, providing insights into which tools deliver the best value and which might be candidates for replacement or consolidation.

Financial Reporting and Analytics

Effective SaaS FinOps requires sophisticated reporting and analytics capabilities:

Cost Trending and Forecasting: Develop reports that show SaaS cost trends over time and provide forecasts for future spending based on current usage patterns and planned business growth.

Departmental Cost Allocation: Implement chargeback or showback models that allocate SaaS costs to the appropriate departments or cost centers, creating accountability and enabling more informed decision-making.

Vendor Consolidation Analysis: Analyze spending patterns to identify opportunities for vendor consolidation, volume discounts, or enterprise agreements that could reduce overall costs.

ROI and Value Assessment: Develop metrics that measure the return on investment for different SaaS applications, considering factors like productivity gains, process improvements, and strategic value.

Implementing Cost Optimization Strategies

With visibility established, organizations can implement targeted cost optimization strategies that deliver immediate savings while building sustainable practices for long-term financial management.

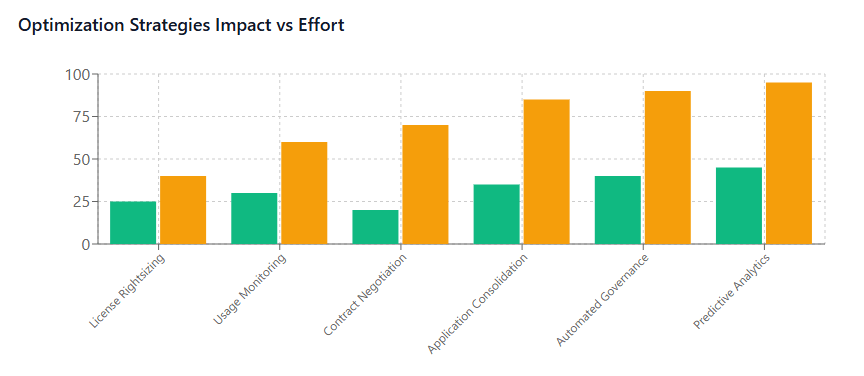

License Rightsizing and Optimization

One of the most immediate opportunities for cost savings lies in optimizing license allocation and subscription levels:

Regular License Audits: Conduct monthly or quarterly audits to identify inactive users, duplicate accounts, and underutilized licenses. Implement processes for automatically deprovisioning licenses for departed employees and reallocating unused licenses to active users.

Subscription Tier Analysis: Review subscription tiers for each application to ensure organizations aren’t paying for features they don’t use. Many SaaS providers offer multiple tiers, and organizations often subscribe to higher tiers than necessary.

Seasonal Usage Patterns: Analyze usage patterns to identify applications with seasonal fluctuations. Some SaaS providers offer flexible licensing that allows organizations to scale up and down based on actual needs.

Bulk Licensing Opportunities: Consolidate individual subscriptions into enterprise agreements where possible. Many vendors offer significant discounts for bulk purchases and multi-year commitments.

Vendor Negotiation and Contract Management

Effective vendor management can yield significant cost savings and improve contract terms:

Renewal Planning: Begin renewal negotiations 6-12 months before contract expiration. This provides sufficient time to evaluate alternatives, negotiate better terms, and avoid automatic renewals at unfavorable rates.

Competitive Benchmarking: Research market rates and alternative solutions before entering renewal negotiations. Having concrete alternatives strengthens negotiating positions and can lead to better pricing and terms.

Contract Standardization: Develop standard contract terms and negotiate consistent language across vendors. This includes standardizing payment terms, cancellation clauses, and data portability requirements.

Volume Discounting: Identify opportunities to consolidate spending across multiple applications from the same vendor or to commit to higher usage levels in exchange for better pricing.

Application Consolidation and Standardization

Strategic consolidation of applications can reduce both direct costs and administrative overhead:

Functional Overlap Analysis: Identify applications with overlapping functionality and develop consolidation plans. For example, organizations might use multiple communication tools (Slack, Microsoft Teams, Google Chat) when one comprehensive solution could meet all needs.

Platform Integration: Prioritize applications that integrate well with existing systems and each other. Integrated platforms often provide better value and reduce the need for point solutions.

User Experience Standardization: Consider the user experience when consolidating applications. Training costs and productivity losses from forcing users to adopt unsuitable tools can offset financial savings.

Data Migration Planning: Develop comprehensive plans for migrating data when consolidating applications. Consider the costs and risks associated with data migration in optimization decisions.

The Cloud Cost Optimization: 5 Best Practices to Reduce Cloud Bills article provides additional insights that can be applied to SaaS cost optimization strategies.

Creating Accountability and Ownership Models

Sustainable SaaS cost management requires clear accountability structures that align financial responsibility with decision-making authority. Creating these ownership models is essential for long-term success.

Chargeback and Showback Models

Implementing financial accountability mechanisms helps drive responsible SaaS usage:

Departmental Chargeback: Allocate actual SaaS costs to the departments that use the applications. This creates direct financial accountability and encourages departments to optimize their own software usage.

Cost Center Allocation: For organizations that prefer not to implement full chargeback, showback models provide visibility into departmental SaaS costs without directly impacting departmental budgets.

Project-Based Allocation: For project-driven organizations, allocate SaaS costs to specific projects or client engagements. This helps with accurate project costing and client billing.

User-Based Metrics: Develop per-user cost metrics that help department managers understand the financial impact of their software requests and usage patterns.

Defining Roles and Responsibilities

Clear role definition ensures that SaaS management responsibilities don’t fall through organizational cracks:

SaaS Owners: Designate specific individuals as owners for each major SaaS application. These owners are responsible for managing users, monitoring usage, and making renewal decisions.

Budget Managers: Clearly define who has budget authority for different categories of SaaS spending. This might be centralized in IT or distributed to department heads, depending on organizational structure.

Technical Administrators: Identify who is responsible for technical aspects like user provisioning, security configuration, and integration management.

Vendor Relationship Managers: Assign responsibility for managing vendor relationships, contract negotiations, and escalation procedures.

Performance Metrics and KPIs

Establish clear metrics that drive the right behaviors and outcomes:

Cost per User: Track the cost per active user for each application, providing insights into value and utilization.

Utilization Rates: Monitor what percentage of purchased licenses are actively used, targeting 80-90% utilization for most applications.

Cost Avoidance: Measure the financial impact of optimization efforts, including avoided renewals, negotiated discounts, and eliminated duplicate applications.

Time to Value: Track how quickly new SaaS investments deliver measurable business value, helping inform future procurement decisions.

Security and Compliance Metrics: Monitor security-related metrics like the percentage of applications that meet security standards and compliance requirements.

Automation and Tool Integration

As SaaS portfolios grow in size and complexity, automation becomes essential for maintaining effective FinOps practices at scale. Organizations must implement sophisticated tools and integration strategies to manage their software investments efficiently.

SaaS Management Platform Integration

Modern SaaS management platforms provide the foundation for automated FinOps practices:

Centralized Discovery and Monitoring: Deploy platforms that automatically discover new SaaS applications and monitor usage patterns across the organization. These systems should integrate with network monitoring tools, identity providers, and financial systems to provide comprehensive visibility.

Automated License Management: Implement systems that can automatically provision and deprovision licenses based on predefined rules. For example, automatically removing licenses for departed employees or reallocating unused licenses to waiting users.

Cost Analytics and Reporting: Leverage platforms that provide sophisticated analytics capabilities, including cost trending, variance analysis, and predictive modeling for future spending.

Workflow Automation: Implement automated workflows for common SaaS management tasks like approval processes, renewal notifications, and usage alerts.

Financial System Integration

Seamless integration between SaaS management tools and financial systems is crucial for comprehensive cost management:

ERP Integration: Connect SaaS management platforms with enterprise resource planning systems to ensure that software costs are properly reflected in financial reporting and budgeting processes.

Procurement System Alignment: Integrate with procurement systems to streamline the software acquisition process and ensure that all purchases follow established approval workflows.

Budget Planning Integration: Ensure that SaaS spending data feeds into annual budget planning processes, providing accurate historical data and trend analysis for future budget development.

Invoice Processing Automation: Implement systems that can automatically match SaaS invoices with contracts and usage data, flagging discrepancies for review before payment.

Identity and Access Management Integration

Effective SaaS management requires tight integration with identity and access management systems:

Single Sign-On Integration: Ensure that all SaaS applications integrate with organizational single sign-on systems, providing both security benefits and usage tracking capabilities.

Automated User Provisioning: Implement systems that can automatically provision users in SaaS applications based on role assignments and organizational changes.

Access Reviews and Compliance: Leverage integrated systems to conduct regular access reviews and ensure compliance with organizational security policies.

Usage Attribution: Use identity integration to accurately attribute SaaS usage to specific users and departments, enabling precise cost allocation and optimization decisions.

Measuring Success and Continuous Improvement

Sustainable SaaS FinOps requires ongoing measurement, analysis, and improvement. Organizations must establish robust metrics and feedback loops to ensure their programs deliver lasting value.

Key Performance Indicators

Establish comprehensive KPIs that measure both financial and operational outcomes:

Financial Metrics: Track total SaaS spending, cost per user, spending growth rates, and savings achieved through optimization efforts. These metrics should be measured monthly and trended over time to identify patterns and opportunities.

Utilization Metrics: Monitor license utilization rates, application adoption rates, and user engagement levels. Target utilization rates of 80-90% for most applications while maintaining adequate capacity for growth.

Operational Metrics: Measure time to provision new users, time to resolve access issues, and the percentage of applications that meet security and compliance standards.

Business Value Metrics: Track productivity improvements, user satisfaction scores, and the business impact of SaaS investments. This might include metrics like reduced time to complete tasks, improved collaboration scores, or enhanced customer satisfaction.

Continuous Optimization Processes

Implement regular processes for ongoing optimization:

Monthly Usage Reviews: Conduct monthly reviews of usage data to identify trends, anomalies, and optimization opportunities. These reviews should involve both technical and business stakeholders.

Quarterly Business Reviews: Hold quarterly reviews with business unit leaders to assess the value delivered by SaaS investments and identify changing requirements or priorities.

Annual Strategic Reviews: Conduct comprehensive annual reviews of the entire SaaS portfolio, including strategic alignment, vendor performance, and long-term roadmap planning.

Continuous Market Analysis: Regularly assess the SaaS market for new solutions, pricing changes, and competitive alternatives that might offer better value or functionality.

Feedback Loops and Stakeholder Engagement

Create mechanisms for ongoing feedback and stakeholder engagement:

User Feedback Collection: Implement regular surveys and feedback mechanisms to understand user satisfaction and identify areas for improvement.

Business Unit Partnerships: Establish regular touchpoints with business unit leaders to understand changing requirements and ensure that SaaS investments align with business objectives.

Vendor Performance Reviews: Conduct regular reviews of vendor performance, including service level adherence, support quality, and roadmap alignment.

Executive Reporting: Provide regular executive reporting that highlights key metrics, achievements, and strategic recommendations for the SaaS portfolio.

Case Studies and Best Practices

Learning from real-world implementations provides valuable insights for organizations building their own SaaS FinOps cultures. Here are key lessons from successful implementations:

Enterprise Success Story: Technology Company

A major technology company with over 10,000 employees successfully implemented a comprehensive SaaS FinOps program that resulted in 25% cost savings within the first year:

Challenge: The organization had over 200 SaaS applications across various departments with no centralized visibility or control. Annual SaaS spending had grown to over $15 million with significant waste and redundancy.

Solution: They implemented a centralized SaaS management platform integrated with their identity management system and established a Center of Excellence with representatives from IT, finance, and procurement.

Results: Within 12 months, they identified and eliminated $3.8 million in redundant and underutilized licenses, consolidated 45% of their applications, and established governance processes that prevented uncontrolled growth.

Key Success Factors: Executive sponsorship, comprehensive discovery processes, and strong collaboration between finance and IT teams.

Mid-Market Success Story: Professional Services Firm

A professional services firm with 2,500 employees transformed their SaaS management approach, achieving both cost savings and improved operational efficiency:

Challenge: Rapid growth had led to uncontrolled SaaS adoption with individual departments making independent software purchases. This resulted in security gaps, compliance issues, and escalating costs.

Solution: They implemented a simplified governance framework with departmental SaaS champions and invested in automated discovery and monitoring tools.

Results: They reduced their SaaS spending by 20% while improving security compliance and user satisfaction. The governance framework prevented the introduction of unauthorized applications while enabling faster approval for legitimate business needs.

Key Success Factors: Focus on simplicity, strong departmental partnerships, and automation of routine tasks.

Small Business Success Story: Startup Scale-Up

A fast-growing startup successfully scaled their SaaS management practices as they grew from 50 to 500 employees:

Challenge: Rapid hiring and expansion had led to ad-hoc software purchases and a lack of visibility into total SaaS costs. The organization needed to establish processes that could scale with their growth.

Solution: They implemented lightweight governance processes and leveraged cost-effective SaaS management tools that could grow with their organization.

Results: They maintained SaaS cost growth below revenue growth rates while ensuring that all employees had access to the tools they needed to be productive.

Key Success Factors: Scalable processes, cost-effective tooling, and integration with existing HR and onboarding processes.

Future-Proofing Your SaaS FinOps Culture

As the SaaS landscape continues to evolve, organizations must prepare for emerging trends and challenges that will impact their FinOps practices.

Emerging Technology Integration

Several emerging technologies will significantly impact SaaS management:

Artificial Intelligence and Machine Learning: AI-powered analytics will provide more sophisticated insights into usage patterns, cost optimization opportunities, and predictive modeling for future needs. Organizations should prepare for solutions that can automatically identify optimization opportunities and even execute certain optimization actions without human intervention.

Advanced Analytics and Business Intelligence: Enhanced analytics capabilities will enable more sophisticated cost modeling, ROI analysis, and business value measurement. This will help organizations make more data-driven decisions about their SaaS investments.

Blockchain and Smart Contracts: Emerging technologies may enable more sophisticated contract management and automated enforcement of usage-based pricing models.

Evolving Vendor Landscape

The SaaS vendor landscape continues to evolve rapidly:

Platform Consolidation: Major cloud providers are expanding their SaaS offerings, potentially reducing the number of vendors organizations need to manage while increasing the importance of platform strategy decisions.

Vertical Specialization: Industry-specific SaaS solutions are becoming more sophisticated, requiring organizations to balance best-of-breed solutions with platform standardization strategies.

Open Source Alternatives: The maturation of open source SaaS alternatives may provide new options for cost-conscious organizations, though this requires evaluation of total cost of ownership including support and maintenance.

Regulatory and Compliance Evolution

Organizations must prepare for evolving regulatory requirements:

Data Privacy Regulations: Increasing data privacy requirements will impact SaaS selection criteria and vendor management practices.

Financial Reporting Requirements: Enhanced requirements for software asset reporting may impact how organizations track and report SaaS investments.

Industry-Specific Compliance: Sector-specific regulations may drive requirements for specific SaaS security and compliance capabilities.

Conclusion

Building a successful FinOps culture around SaaS spend requires a comprehensive approach that combines technology, process, and cultural change. Organizations that successfully implement these practices achieve not only cost savings but also improved operational efficiency, better security compliance, and enhanced business agility.

The key to success lies in starting with clear visibility into current SaaS usage and costs, establishing governance frameworks that balance control with agility, and implementing automation tools that scale with organizational growth. Most importantly, success requires ongoing commitment to measurement, optimization, and continuous improvement.

As organizations continue to embrace digital transformation and cloud-based solutions, those with mature SaaS FinOps practices will be better positioned to maximize the value of their software investments while controlling costs. By following the frameworks and best practices outlined in this guide, organizations can build sustainable FinOps cultures that deliver lasting value.

The journey to effective SaaS spend management is ongoing, requiring continuous adaptation to new technologies, evolving vendor landscapes, and changing business requirements. However, organizations that invest in building strong FinOps cultures around their SaaS spending will be well-positioned to thrive in an increasingly software-driven business environment.

Remember that building a FinOps culture is not just about implementing tools and processes—it’s about creating an organizational mindset that values financial accountability, continuous optimization, and data-driven decision making. With the right combination of leadership commitment, cross-functional collaboration, and technological enablement, any organization can build a successful SaaS FinOps practice that delivers measurable business value.

For organizations looking to implement comprehensive SaaS spend management solutions, platforms like Binadox provide the visibility, automation, and analytics capabilities needed to build and maintain effective FinOps practices at scale. The key is to start with a clear understanding of current challenges and opportunities, then build incrementally toward a comprehensive FinOps culture that aligns with organizational goals and capabilities.