Executive Summary

For CFOs, navigating the cloud transformation isn’t just about controlling costs—it’s about ensuring financial predictability in an environment that thrives on agility and decentralization. The rapid pace of digital transformation, remote collaboration, and increased reliance on third-party tools all converge to increase complexity in financial planning. Thus, cloud cost forecasting is not a siloed IT responsibility—it’s a board-level imperative aligned with strategic growth.

As enterprises shift critical workloads to AWS, Azure, Google Cloud, and niche providers, finance leaders face a moving target: today’s bill rarely predicts next quarter’s spend. Volatile on-demand pricing, opaque discounts, and unpredictable project demand can turn a carefully planned OpEx budget into a surprise overspend. This guide gives CFOs a repeatable framework—backed by Binadox best-practice tooling—to forecast multi-cloud and SaaS costs with confidence while embedding guardrails that prevent overruns.

Why Forecasting Multi-Cloud Spend Is So Challenging

Furthermore, many CFOs face limitations in visibility due to organizational silos. Procurement, IT, and finance often work with different tools, metrics, and reporting structures, leading to delayed awareness of budget deviations. A unified, real-time view across departments is vital for detecting and correcting cost deviations proactively.

| Forecasting Obstacle | Why It Breaks Budgets |

|---|---|

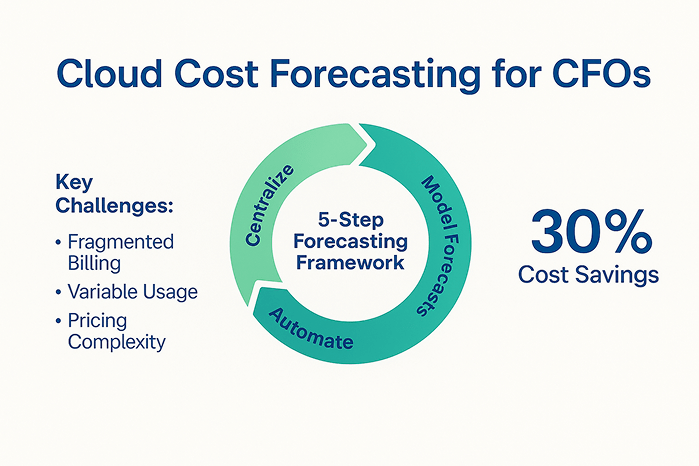

| Fragmented Billing | Each cloud issues its own invoices, currencies, and tax rules. Re-conciling takes days. |

| Variable Consumption | Dev teams spin resources up/down continuously; yesterday’s usage ≠ tomorrow’s. |

| Pricing Complexity | Reserved Instances, Savings Plans, spot markets, egress fees, and enterprise-level custom discounts shift unit costs monthly. |

| Exchange-Rate Risk | Global teams pay in USD, EUR, JPY—swings can mask real usage growth. |

| Shadow IT/SaaS Sprawl | Employees buy SaaS on cards; the finance team sees costs only after renewal. |

Binadox research shows that uncontrolled SaaS adoption and failure to cancel unused subscriptions are consistent cost-leak culprits.

The Data CFOs Actually Need

Beyond technical metrics, CFOs also require financial insights layered with business context. For instance, understanding cost per business outcome—like cost per lead generated or cost per product shipped—makes forecasting a strategic rather than tactical tool. CFOs can then better prioritize investments that align with performance metrics.

- Unified cost and usage exports from every cloud account and SaaS vendor.

- Business-driver metrics (users, transactions, sprint velocity) to link spend to revenue.

- Rate-card intelligence—on-demand vs. reserved vs. spot vs. committed-use prices.

- Resource metadata & tags to allocate cost back to product lines, cost centres, and projects.

- Historical anomaly log to identify one-off spikes worth excluding from trend lines (e.g., a security patch that doubled egress for two days).

To speak the same language across IT and Finance, share a glossary of cloud computing terminology with budget owners.

A Five-Step Forecasting Framework

This framework is also adaptable to changing business cycles. Whether a company is scaling during a high-growth phase or entering cost-containment mode, these steps provide the flexibility to align cloud spending with operational rhythms. Incorporating driver-based forecasting not only improves accuracy but also encourages accountability across business units.

| Step | Action | Outcome |

|---|---|---|

| 1. Centralize Spend Data | Connect AWS, Azure, GCP, DigitalOcean, 40+ SaaS apps to a single platform. Binadox integrations take minutes. | One trusted source of truth. |

| 2. Normalize & Tag | Auto-apply or enforce B-tags (team, region, environment) across accounts. | Clean dimensions for allocation. |

| 3. Model Driver-Based Forecasts | Build scenarios that flex usage-drivers (users, API calls) instead of straight-line growth. | Forecasts that reflect business reality. |

| 4. Stress-Test With Scenarios | Layer “what-if” models—20 % user growth, new region, currency swings. | See budget impact before commitment. |

| 5. Automate Guardrails | Use Binadox Automation Rules to shut down idle dev/test, cap daily budgets, and alert on anomalies. | Stop overspend before invoice arrives. |

4 Tool Spotlight: Forecasting With Binadox

With the pace of SaaS adoption, license tracking has emerged as a critical capability. Binadox’s visibility into license usage trends supports proactive vendor negotiations and decommissioning of unused applications. Additionally, integrating forecasting with FinOps practices drives a cultural shift where engineering and finance collaborate on cloud cost optimization as a shared goal.

| Binadox Capability | How It Protects Your Budget |

|---|---|

| Multi-Cloud Dashboard | Consolidates AWS, Azure, GCP, DigitalOcean costs and overlays daily budgets so Finance sees overruns immediately. |

| Cost Explorer & Anomaly Detection | Highlights spikes—you set the variance threshold and period; outliers are flagged for investigation. |

| Rightsizing Engine | Simulates new instance sizes and shows forecasted savings before changes go live. |

| IaC Cost Tracker | Estimates cost of every Terraform plan, ensuring new infrastructure fits the forecast. |

| License Manager for SaaS | Projects upcoming renewals, letting CFOs re-allocate or cancel under-utilized licenses ahead of time. |

Result: Binadox customers typically cut 30 % of addressable cloud waste and bring SaaS renewal surprises to zero.

5 CFO Checklist to Avoid Budget Overruns

To strengthen forecasting discipline, CFOs should embed regular cloud cost reviews in executive dashboards and board reporting. These checkpoints serve not only to evaluate spending trends but also to communicate value generation from cloud investments. The checklist is a living framework that should evolve with business goals and IT maturity.

- Enforce a single source of spend truth—no Excel roll-ups.

- Review forecast vs. actuals weekly; investigate >5 % variance immediately.

- Commit-to-save, but monitor utilisation of Reserved Instances/Savings Plans monthly.

- Rightsize quarterly—CPU, memory, storage and SaaS seat counts.

- Automate idle shut-off policies for non-production workloads.

- Negotiate enterprise & bulk SaaS discounts ahead of renewal windows.

- Communicate in business KPIs (cost per customer, per API call) to keep engineering engaged.

Conclusion

Adopting a forecasting mindset positions CFOs as strategic enablers rather than cost controllers. When supported by intelligent tools like Binadox, finance leaders can shift from retrospective reporting to proactive financial engineering. This empowers organizations to balance innovation velocity with fiscal responsibility, creating sustainable competitive advantage in the cloud-first era.

Cloud cost forecasting is no longer a back-office exercise; it is a strategic competency that lets CFOs fund innovation without financial shock. By unifying multi-cloud and SaaS data, building driver-based models, and automating preventive guardrails, finance leaders can turn the volatility of the cloud into a predictable, optimised spend curve. Binadox provides the instrumentation—integrations, analytics, rightsizing, and automated actions—that lets you execute this framework at scale and keep next quarter’s bill exactly where you expect it.

Ready to see your own numbers? Launch a 7-day trial and test Binadox forecasting with your real workloads.