The financial services industry has undergone a massive digital transformation, with banks and financial institutions increasingly adopting cloud computing technologies to enhance operational efficiency, improve customer experiences, and maintain competitive advantages. However, as organizations embrace multi-cloud strategies and expand their digital infrastructure, managing cloud costs has become a critical challenge that directly impacts profitability and operational sustainability.

Cloud cost optimization in the banking sector requires specialized approaches that consider regulatory compliance, security requirements, and the unique operational demands of financial services. This comprehensive guide explores how financial institutions can effectively manage their multi-cloud expenses while maintaining the highest standards of security and compliance.

The Current State of Cloud Adoption in Financial Services

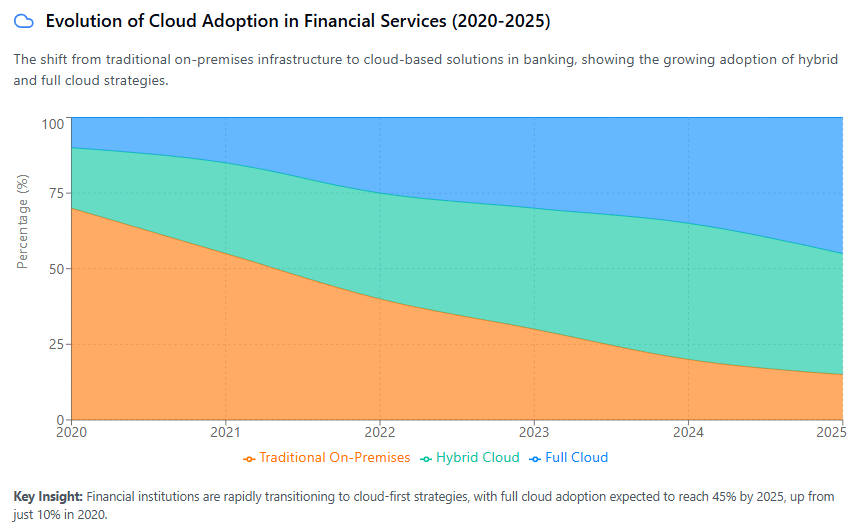

Financial institutions are rapidly migrating to cloud-based solutions, driven by the need for scalable infrastructure, enhanced data analytics capabilities, and improved customer service delivery. According to industry reports, the global cloud computing market in the financial services sector has experienced exponential growth, with organizations utilizing multiple cloud providers to avoid vendor lock-in and optimize performance.

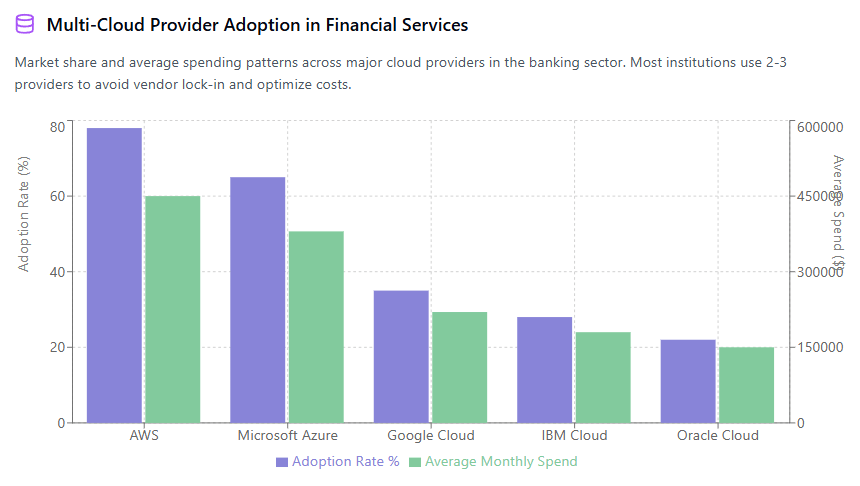

Banks typically operate in multi-cloud environments, leveraging different providers for various services. Amazon Web Services (AWS) might host their data analytics platforms, Microsoft Azure could power their customer relationship management systems, and Google Cloud Platform may support their machine learning initiatives. This distributed approach, while offering flexibility and resilience, creates complex cost management challenges.

The hybrid cloud vs. multi-cloud approach adopted by many financial institutions requires sophisticated monitoring and optimization strategies. Unlike single-cloud deployments, multi-cloud environments demand comprehensive visibility across all platforms to identify cost optimization opportunities and prevent unnecessary expenses.

Understanding Cloud Cost Challenges in Banking

Regulatory Compliance Costs

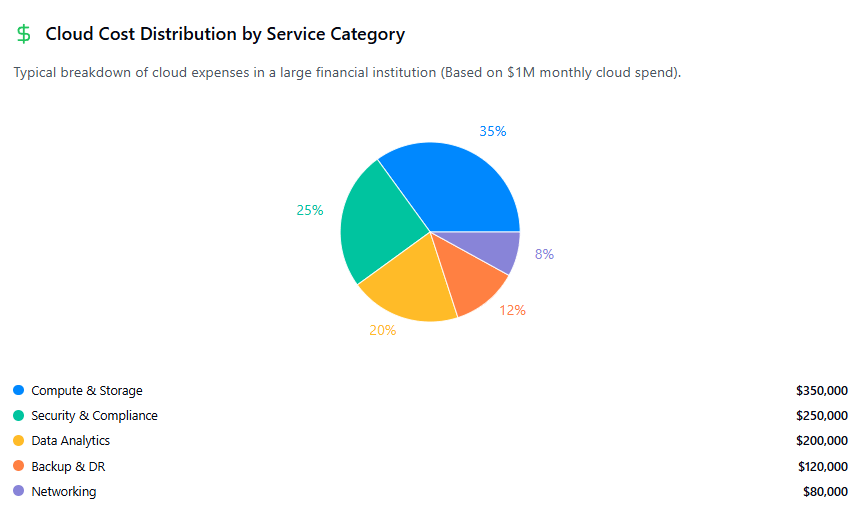

Financial institutions must maintain strict compliance with regulations such as SOX, PCI DSS, GDPR, and various local banking regulations. These compliance requirements often necessitate additional security measures, data governance tools, and monitoring systems that can significantly impact cloud costs. The shared responsibility model for cloud security becomes particularly complex in financial services, where organizations must ensure both cloud provider and internal compliance measures are adequately funded and maintained.

Security Infrastructure Expenses

Banking organizations require robust security infrastructure, including advanced threat detection systems, encryption services, and continuous monitoring tools. These security measures often involve premium cloud services and specialized security solutions that command higher costs but are essential for protecting sensitive financial data and maintaining customer trust.

Data Management and Storage Costs

Financial institutions generate and store vast amounts of transactional data, customer information, and regulatory documentation. The costs associated with data storage, backup, disaster recovery, and data lifecycle management can quickly escalate in cloud environments, particularly when organizations fail to implement proper data governance and retention policies.

Multi-Cloud Complexity

Managing expenses across multiple cloud providers introduces operational complexity that can lead to cost inefficiencies. Different pricing models, billing cycles, and service offerings across providers make it challenging to maintain centralized cost visibility and optimization strategies.

Strategic Approaches to Cloud Cost Optimization

Implementing Centralized Cost Management

Successful cloud cost optimization in financial services begins with establishing centralized visibility and control over all cloud expenditures. Organizations should implement comprehensive cloud cost management platforms that provide unified dashboards, detailed spending analytics, and automated cost tracking across all cloud providers.

A cloud management strategy should include centralized procurement processes that ensure all cloud services are approved, monitored, and optimized according to organizational policies. This approach prevents shadow IT spending and ensures that all cloud investments align with business objectives and compliance requirements.

Leveraging Advanced Analytics for Cost Insights

Financial institutions can leverage their existing data analytics capabilities to gain deeper insights into cloud spending patterns. By analyzing usage data, cost trends, and performance metrics, organizations can identify optimization opportunities and predict future spending requirements more accurately.

Advanced analytics can help identify underutilized resources, optimize workload placement across different cloud providers, and predict seasonal spending variations that are common in financial services. These insights enable proactive cost management rather than reactive cost reduction measures.

Implementing Automated Cost Controls

Automation plays a crucial role in managing multi-cloud expenses in financial services. Organizations should implement automated policies that control resource provisioning, enforce spending limits, and optimize resource allocation based on actual usage patterns.

Automated cost controls can include scheduled resource scaling, automatic shutdown of non-production environments during off-hours, and intelligent workload distribution across cloud providers based on cost-effectiveness. These automation strategies help maintain operational efficiency while controlling expenses.

Best Practices for Multi-Cloud Financial Services Environments

Standardizing Cloud Governance Policies

Financial institutions should establish standardized governance policies that apply across all cloud providers and services. These policies should address resource tagging standards, approval workflows, security requirements, and cost allocation methodologies.

Consistent governance policies ensure that cost optimization efforts are aligned across the organization and that spending can be accurately tracked and attributed to specific business units, projects, or regulatory requirements.

Implementing Resource Tagging Strategies

Comprehensive resource tagging is essential for effective cost management in multi-cloud environments. Financial institutions should implement standardized tagging strategies that enable cost allocation by business unit, application, environment, compliance requirement, and cost center.

Proper tagging enables organizations to understand which applications and services drive the highest costs, identify optimization opportunities, and ensure accurate cost attribution for internal billing and budgeting purposes.

Optimizing SaaS Spend Management

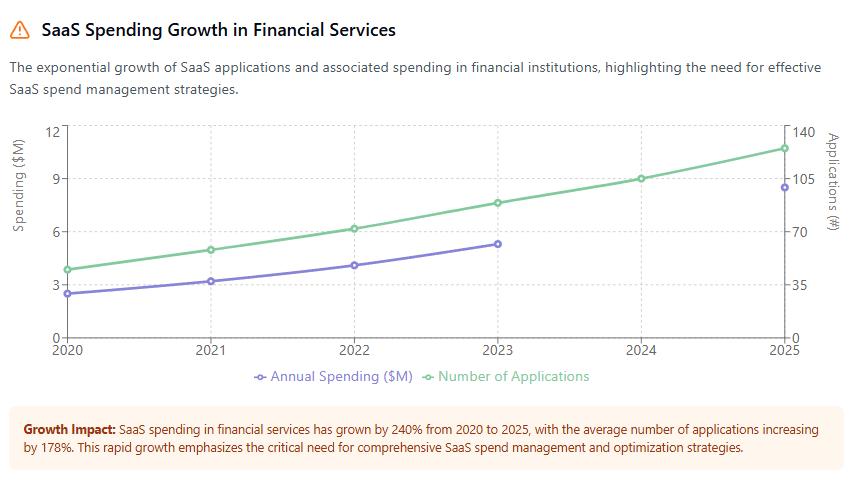

Beyond infrastructure costs, financial institutions must also manage their software-as-a-service (SaaS) expenses effectively. SaaS spend management involves tracking subscription costs, optimizing license utilization, and eliminating redundant applications.

Many financial institutions use dozens of SaaS applications for various business functions, from customer relationship management to regulatory reporting. Effective SaaS spend management ensures that organizations only pay for licenses that are actively used and that duplicate functionality is eliminated across different applications.

Establishing Cost Allocation Models

Financial services organizations should implement sophisticated cost allocation models that accurately distribute cloud expenses across business units, products, and regulatory requirements. These models should consider direct usage costs as well as shared infrastructure and compliance expenses.

Accurate cost allocation enables business units to understand their true cloud consumption costs and makes informed decisions about resource utilization and optimization. It also supports regulatory reporting requirements that may mandate specific cost tracking and allocation methodologies.

Technology Solutions for Cloud Cost Optimization

Multi-Cloud Management Platforms

Financial institutions should invest in comprehensive multi-cloud management platforms that provide unified visibility, control, and optimization capabilities across all cloud providers. These platforms should offer real-time cost monitoring, budget alerts, and automated optimization recommendations.

Modern cloud management platforms leverage artificial intelligence and machine learning to identify cost optimization opportunities, predict spending trends, and recommend specific actions to reduce expenses while maintaining performance and compliance requirements.

Integration with Financial Systems

Cloud cost management solutions should integrate seamlessly with existing financial systems, including enterprise resource planning (ERP) platforms, budgeting tools, and financial reporting systems. This integration ensures that cloud costs are properly tracked, budgeted, and reported according to organizational financial management processes.

Integration capabilities enable automated cost allocation, budget tracking, and variance analysis that help financial institutions maintain strict financial controls over their cloud investments.

Scalability in Cloud Computing Optimization

Understanding scalability in cloud computing is crucial for financial institutions that experience variable workloads throughout different business cycles. Organizations should implement elastic scaling strategies that automatically adjust resources based on demand while maintaining cost efficiency.

Proper scalability planning ensures that financial institutions can handle peak transaction volumes during busy periods while scaling down resources during quieter times to optimize costs.

Advanced Cost Optimization Strategies

Right-Sizing and Performance Optimization

Regular right-sizing exercises help ensure that cloud resources are appropriately sized for their workloads. Financial institutions should continuously monitor resource utilization and adjust instance sizes, storage allocations, and network configurations to optimize both performance and costs.

Performance optimization strategies should consider the unique requirements of financial applications, including low-latency trading systems, high-availability customer portals, and batch processing systems for regulatory reporting.

Reserved Capacity and Commitment Planning

Financial institutions with predictable workloads should leverage reserved capacity options and commitment-based pricing models offered by cloud providers. These options can provide significant cost savings for stable workloads while maintaining the flexibility to scale for variable demands.

Commitment planning requires careful analysis of historical usage patterns and future growth projections to optimize the balance between cost savings and flexibility.

Data Lifecycle Management

Implementing comprehensive data lifecycle management strategies can significantly reduce storage costs in financial services environments. Organizations should establish policies for data archiving, retention, and deletion that comply with regulatory requirements while optimizing storage expenses.

Automated data lifecycle management tools can move infrequently accessed data to lower-cost storage tiers and ensure that data retention policies are consistently applied across all cloud environments.

Measuring Success and Continuous Improvement

Key Performance Indicators

Financial institutions should establish specific key performance indicators (KPIs) to measure the success of their cloud cost optimization efforts. These metrics should include cost per transaction, cloud spend as a percentage of IT budget, cost optimization savings achieved, and compliance-related cost efficiency.

Regular monitoring of these KPIs enables organizations to track progress, identify areas for improvement, and demonstrate the value of cloud cost optimization initiatives to stakeholders.

Regular Cost Reviews and Audits

Implementing regular cost review processes ensures that optimization efforts remain effective over time. These reviews should analyze spending trends, assess the effectiveness of cost control measures, and identify new optimization opportunities.

Cost audits should also verify that cloud spending aligns with budgets, compliance requirements, and business objectives. Regular audits help maintain financial discipline and ensure that cost optimization remains a priority across the organization.

Continuous Learning and Adaptation

The cloud computing landscape continues to evolve rapidly, with new services, pricing models, and optimization tools constantly emerging. Financial institutions should maintain continuous learning programs that keep their teams updated on new cost optimization opportunities and best practices.

Organizations should also regularly reassess their cloud strategies and cost optimization approaches to ensure they remain aligned with changing business requirements, regulatory updates, and technological advancements.

Conclusion

Cloud cost optimization in financial services requires a comprehensive approach that balances cost efficiency with security, compliance, and performance requirements. Organizations that successfully manage their multi-cloud expenses implement centralized governance, leverage advanced analytics, and maintain continuous optimization processes.

The key to success lies in establishing clear policies, implementing appropriate technology solutions, and maintaining organizational discipline around cost management. Financial institutions that prioritize cloud cost optimization will be better positioned to maximize the value of their cloud investments while maintaining the operational efficiency and regulatory compliance essential to their business success.

By following the strategies and best practices outlined in this guide, financial services organizations can achieve significant cost savings while building more efficient, scalable, and compliant cloud environments. The investment in proper cloud cost optimization capabilities will continue to deliver value as organizations expand their digital transformation initiatives and increase their reliance on cloud-based solutions.

Effective cloud cost optimization is not just about reducing expenses—it’s about creating a sustainable foundation for digital innovation and growth in the competitive financial services landscape. Organizations that master these capabilities will be better equipped to adapt to future challenges and opportunities in the rapidly evolving digital economy.