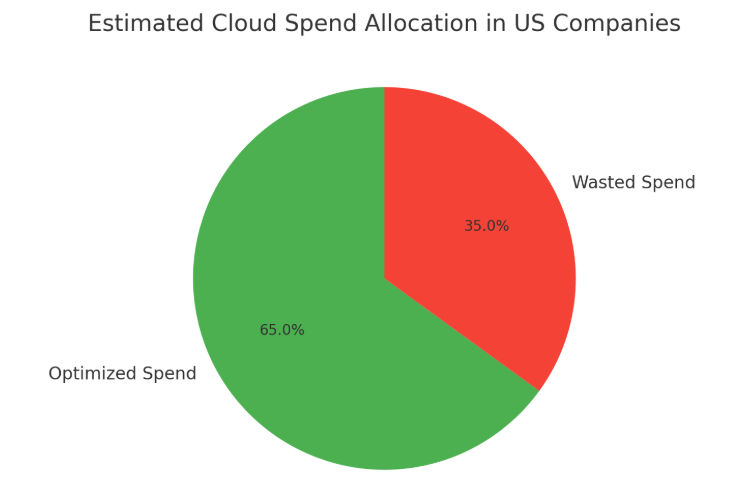

The cloud has become the backbone of digital transformation in the United States. From large-scale enterprises in healthcare and finance to small startups in retail and technology, organizations are migrating to public, private, and hybrid cloud environments to gain agility, scalability, and faster innovation. Yet with these advantages comes an equally pressing challenge: costs that are difficult to forecast and even harder to control. Many US executives admit that despite massive investments in cloud migration, the returns are not always transparent, and financial waste often offsets the efficiency gains.

This tension has given rise to FinOps—a discipline that blends financial accountability with cloud engineering practices. More than just a method for controlling budgets, FinOps is a cultural shift that requires collaboration between finance, engineering, operations, and business stakeholders. In the US market, where cloud adoption is pervasive and digital competition fierce, FinOps is emerging not as a trend but as a fundamental requirement for sustainable growth.

The journey toward FinOps adoption is not straightforward. It requires organizational changes, technology investments, and a rethinking of how companies view financial responsibility. But when implemented effectively, FinOps transforms cloud financial management from a reactive budgeting exercise into a proactive strategy that aligns spending with business value.

Why US Companies Need FinOps

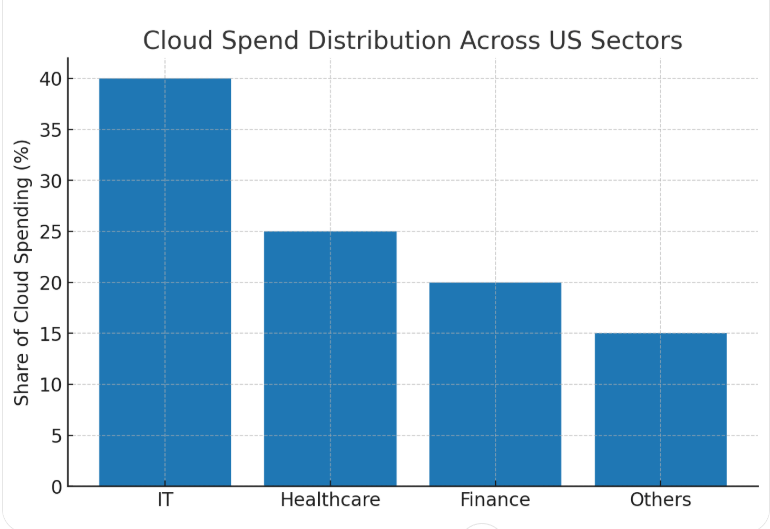

Over the past decade, cloud spending in the United States has accelerated at record pace. According to market research, US firms account for the majority share of global cloud consumption, with AWS, Microsoft Azure, and Google Cloud holding dominant positions. The economic rationale is compelling: cloud services offer elasticity, speed, and scalability unmatched by traditional on-premises infrastructure. But those same advantages introduce complexity. Pricing models change frequently, workloads scale up and down unpredictably, and teams often adopt services outside the purview of IT.

This creates what industry experts call “cloud cost sprawl.” For a mid-sized American enterprise, dozens of business units may be provisioning resources across multiple cloud platforms without centralized visibility. SaaS applications further compound the problem, as employees often subscribe independently to collaboration tools, storage services, and niche applications. Without governance, the result is duplicate subscriptions, underutilized licenses, and mounting financial waste.

FinOps addresses this gap by placing financial responsibility at the center of cloud operations. For US organizations that must navigate strict regulatory environments, volatile economic conditions, and increasingly complex digital ecosystems, FinOps offers a framework to ensure that cloud spending delivers measurable business outcomes.

Foundations of a FinOps Culture

Establishing a FinOps culture begins with breaking down traditional silos between finance and technology. Historically, finance teams handled budgets at the end of a project cycle, while engineers focused solely on performance and delivery. In cloud environments, this model no longer works. Costs are incurred in real time, and decisions about architecture or scaling can have immediate financial consequences.

In a FinOps culture, financial accountability becomes shared. Engineers are educated about the financial impact of provisioning decisions, while finance professionals gain visibility into technical considerations. Cloud cost data is made available daily rather than quarterly, enabling proactive decisions rather than reactive reconciliations. Leadership plays a crucial role here, setting the expectation that every department has a stake in financial efficiency.

Transparency is another foundational element. Instead of cost data being confined to spreadsheets within finance departments, it is made accessible across the organization. Dashboards provide real-time insights, ensuring that everyone—from engineers to product managers—understands the financial implications of their actions. Over time, this transparency creates a culture in which financial management is no longer perceived as an external constraint but as an integral part of operational excellence.

Challenges in the US Context

While the principles of FinOps are universal, US companies face specific challenges in implementation. The first is regulatory oversight. Sectors such as healthcare, banking, and insurance require meticulous tracking of cloud expenses to comply with industry regulations and audits. A lack of accurate reporting can lead not only to financial inefficiencies but also to compliance risks that carry heavy penalties.

Another challenge is the prevalence of hybrid and multi-cloud strategies. Many US organizations deliberately distribute workloads across multiple providers to avoid vendor lock-in or to optimize performance. While strategically sound, this diversification complicates financial management. Each vendor has unique pricing models, discount structures, and reporting formats. Reconciling costs across platforms becomes a formidable task without the automation and visibility FinOps provides.

Cultural resistance is also significant. In many US enterprises, engineers are incentivized to deliver speed and performance, not to reduce costs. Asking them to balance financial efficiency with technical output can create tension unless accompanied by training, leadership support, and clear communication about shared objectives.

Practical Steps Toward Implementation

Building a FinOps practice in the American corporate environment involves several interwoven steps. The first is forming a cross-functional FinOps team. Rather than treating financial management as the domain of a single department, US companies increasingly assemble dedicated teams composed of finance leaders, cloud architects, DevOps engineers, and procurement specialists. These teams establish policies, define cost allocation strategies, and act as a bridge between technical and financial decision-making.

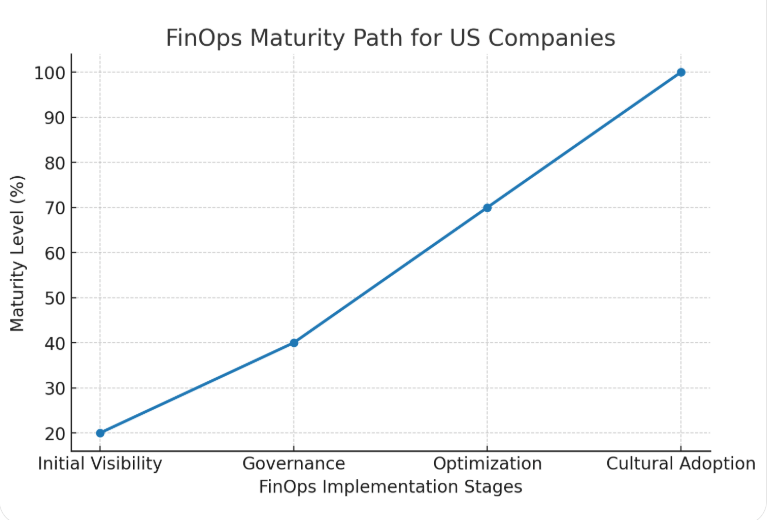

Next comes establishing visibility. This is perhaps the most critical step, as companies cannot manage what they cannot measure. Visibility requires consolidating data from multiple cloud providers, normalizing it across platforms, and presenting it in an accessible way. Solutions like Binadox offer dashboards that allow organizations to track SaaS and cloud usage, visualize expenses by team or project, and detect anomalies that might indicate waste.

Once visibility is established, governance frameworks must be introduced. US companies benefit from defining tagging standards, budget thresholds, and approval workflows for provisioning new resources. Governance ensures accountability while still allowing teams the flexibility to innovate. Importantly, governance is not a one-time exercise; it must evolve as the organization’s cloud footprint grows.

Optimization follows naturally from governance. Rightsizing workloads, shutting down idle resources, and negotiating vendor discounts are examples of optimization strategies. Tools like Binadox assist with automation here, identifying underutilized resources and recommending alternative configurations. For US companies with large-scale cloud deployments, automation is crucial—manual oversight is simply not feasible at scale.

Finally, implementation must address culture. Training programs, leadership endorsement, and ongoing communication campaigns embed FinOps principles into everyday operations. Success should be measured not just in terms of cost savings but also in improved collaboration, faster decision-making, and greater alignment between business goals and technology investments.

The Role of Technology Platforms in FinOps

Technology platforms provide the backbone for FinOps adoption. Without automation and analytics, the complexity of cloud environments would overwhelm even the most disciplined financial teams. Binadox, for example, has become a critical enabler of FinOps practices in US companies.

By consolidating cloud and SaaS expenses into a single platform, Binadox eliminates the blind spots that plague many organizations. Finance leaders can track real-time spending across AWS, Azure, Google Cloud, and dozens of SaaS vendors, while engineers can access detailed utilization data to guide optimization decisions. The platform’s Renewals Calendar ensures that upcoming SaaS payments are visible, preventing the all-too-common problem of auto-renewed licenses that go unused.

Beyond visibility, Binadox enhances governance through tagging frameworks and anomaly detection. Its automation rules allow US companies to enforce policies at scale, whether that means shutting down idle resources after hours or sending alerts when costs exceed defined thresholds. By embedding such tools into their workflows, organizations transition from reactive cost management to proactive financial governance.

Building a Sustainable Culture of Cloud Financial Management

At its heart, FinOps is not just about technology or processes—it is about culture. Building a sustainable culture of cloud financial management in US companies requires rethinking incentives, values, and collaboration structures. Engineers must see financial accountability as part of their craft, not as a constraint imposed by finance. Finance leaders, in turn, must embrace the dynamic, fast-paced nature of cloud environments rather than attempting to apply static budgeting models.

One effective strategy for fostering culture is storytelling. Sharing case studies within the organization about how a team reduced costs while maintaining performance can inspire others to follow suit. Similarly, celebrating financial wins—such as negotiating a vendor discount or eliminating duplicate SaaS subscriptions—creates momentum and reinforces desired behaviors.

Another cultural enabler is education. US companies that successfully implement FinOps often invest in training programs that teach both engineers and finance teams how to interpret cloud cost data, forecast spending, and evaluate trade-offs. Over time, this education transforms financial management from a specialized skill into an organization-wide competency. For further background, resources like Basic Cloud Computing Terminology provide accessible guides to foundational concepts.

Case Study: Transformation in Practice

Consider the example of a US-based healthcare provider operating across multiple states. Facing skyrocketing cloud bills and growing compliance concerns, the company adopted a FinOps framework with the help of Binadox. Initially, the organization had little visibility into SaaS usage, with more than fifty applications subscribed through various departments. Cloud infrastructure was equally fragmented, spread across AWS and Azure with minimal tagging or governance.

By centralizing cost data through Binadox, the provider quickly identified underutilized resources and duplicate SaaS licenses. Over six months, it reduced cloud waste by thirty percent and consolidated several SaaS applications into enterprise agreements that offered better pricing. More importantly, the company shifted its culture. Engineers began reviewing cost dashboards as part of their daily workflows, and finance teams gained confidence in forecasting expenditures for compliance reporting. What started as a cost-saving initiative evolved into a cultural transformation that aligned technology, finance, and compliance objectives.

The Future of FinOps in the United States

Looking ahead, FinOps is expected to evolve alongside cloud technologies. Artificial intelligence and machine learning will play a growing role in predictive cost management, allowing US companies to forecast usage spikes and detect anomalies before they occur. Sustainability will also shape the FinOps agenda, as organizations align cloud optimization with environmental, social, and governance (ESG) goals. For example, companies may evaluate workloads not only by financial cost but also by carbon footprint.

Industry-specific frameworks will continue to emerge. Healthcare, finance, and government agencies in the US will adapt FinOps principles to meet their unique compliance requirements, while startups will leverage lightweight versions of the discipline to maintain agility without sacrificing accountability.

Ultimately, the trajectory is clear: FinOps will become a standard operating model for any US company leveraging the cloud. Those who adopt early will enjoy not only financial savings but also enhanced agility and resilience in an unpredictable market.

Conclusion

FinOps represents a profound shift in how US companies approach cloud financial management. No longer can organizations afford to treat cloud costs as an afterthought or a line item buried in quarterly budgets. Instead, financial accountability must become embedded in the culture of technology operations.

By breaking down silos, investing in visibility tools such as Binadox, and fostering a culture of shared responsibility, US companies can transform cloud spending into a strategic advantage. The benefits extend beyond cost reduction: FinOps enables better collaboration, faster innovation, improved compliance, and stronger alignment between business goals and technology investments.

As cloud adoption continues to reshape the American business landscape, FinOps stands as the bridge between financial discipline and digital innovation. Companies that embrace this cultural shift will not only survive but thrive in the new era of cloud-driven competition.