Introduction

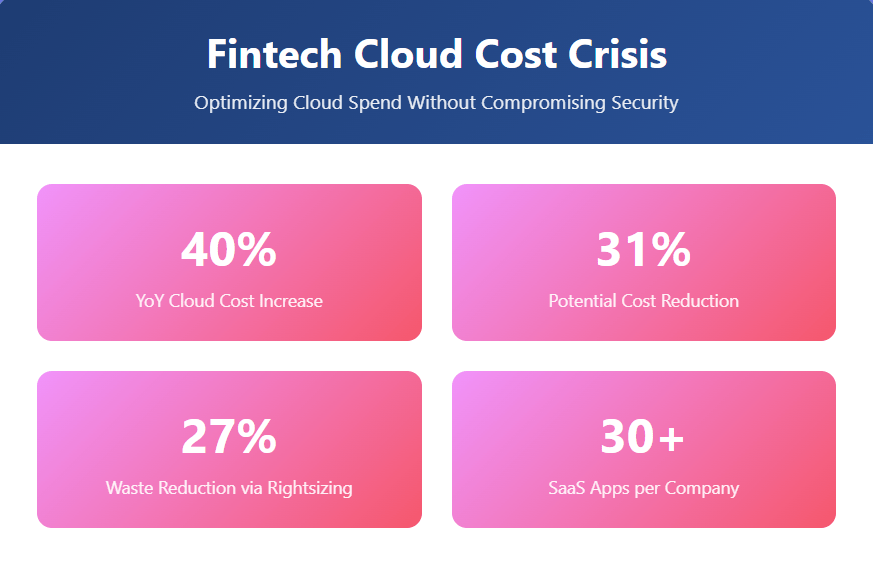

The fintech industry is built on innovation and digital agility, harnessing the power of cloud computing to drive rapid product development, ensure compliance, and deliver a seamless customer experience. Yet, as cloud adoption accelerates, many fintech companies are grappling with ballooning cloud costs—often with little visibility into where spend is going or how to control it. Worse, aggressive cost-cutting can risk undermining the robust security and compliance foundations that fintech must uphold.

Is it possible to cut cloud spend without compromising security? The answer is yes, but it requires a strategic approach—one that’s data-driven, automated, and tailored to the unique regulatory and operational demands of financial technology. In this article, we’ll explore proven strategies to optimize cloud usage and costs, highlight security pitfalls to avoid, and introduce the latest tools—like Binadox—that help fintechs achieve more with less.

The Cloud Conundrum in Fintech

Why Fintech Companies Are Heavy Cloud Users

Fintech companies, from digital banks to payment processors and insurtech startups, rely heavily on cloud services for several reasons:

- Agility: Cloud platforms allow rapid scaling to handle volatile transaction volumes.

- Compliance: Public cloud vendors invest heavily in certifications (PCI DSS, SOC2, etc.), making it easier for fintechs to meet regulatory requirements.

- Cost Model: Pay-as-you-go cloud pricing aligns well with unpredictable growth patterns.

- Innovation: Access to advanced analytics, AI/ML, and APIs accelerates product launches.

But with great power comes great responsibility—and complexity. Multi-cloud environments, dozens of SaaS subscriptions, and decentralized purchasing mean costs can spiral quickly and security gaps can emerge.

Where Cloud Spend Gets Out of Control

Common causes of excessive cloud spend in fintech include:

- Resource Sprawl: Unused or underutilized compute/storage resources accumulate as teams experiment or forget to shut down test environments.

- Over-provisioning: Teams err on the side of caution, over-allocating capacity to avoid performance issues during traffic spikes.

- Decentralized SaaS Adoption: Individual departments purchase overlapping SaaS tools, leading to duplicate licenses and poor negotiation leverage.

- Lack of Cost Visibility: Without granular, real-time dashboards, finance and IT teams can’t pinpoint which projects or products drive the most spend.

- Inefficient Data Retention: Compliance-mandated logs and backups are kept indefinitely, often on expensive storage tiers.

These issues are compounded by the fact that fintechs cannot simply turn off workloads or delay upgrades if it means jeopardizing regulatory compliance or customer trust.

The Security Imperative: Why Cost Cutting Can’t Come at the Expense of Compliance

Cloud cost optimization must never undermine fintech’s security and regulatory posture. Key risks include:

- Disabling Critical Controls: Shutting down security tools (e.g., DLP, SIEM, WAF) to save money exposes sensitive financial data to threats.

- Uncontrolled De-provisioning: Rapid deletion of resources can result in loss of audit trails, backups, or encryption keys required for compliance.

- Shadow IT: If central IT cuts too aggressively, business units may bypass controls and spin up unsanctioned cloud resources.

Effective spend management, therefore, must go hand-in-hand with security monitoring, continuous compliance, and granular access control.

Step-by-Step Strategies to Slash Cloud Spend—Securely

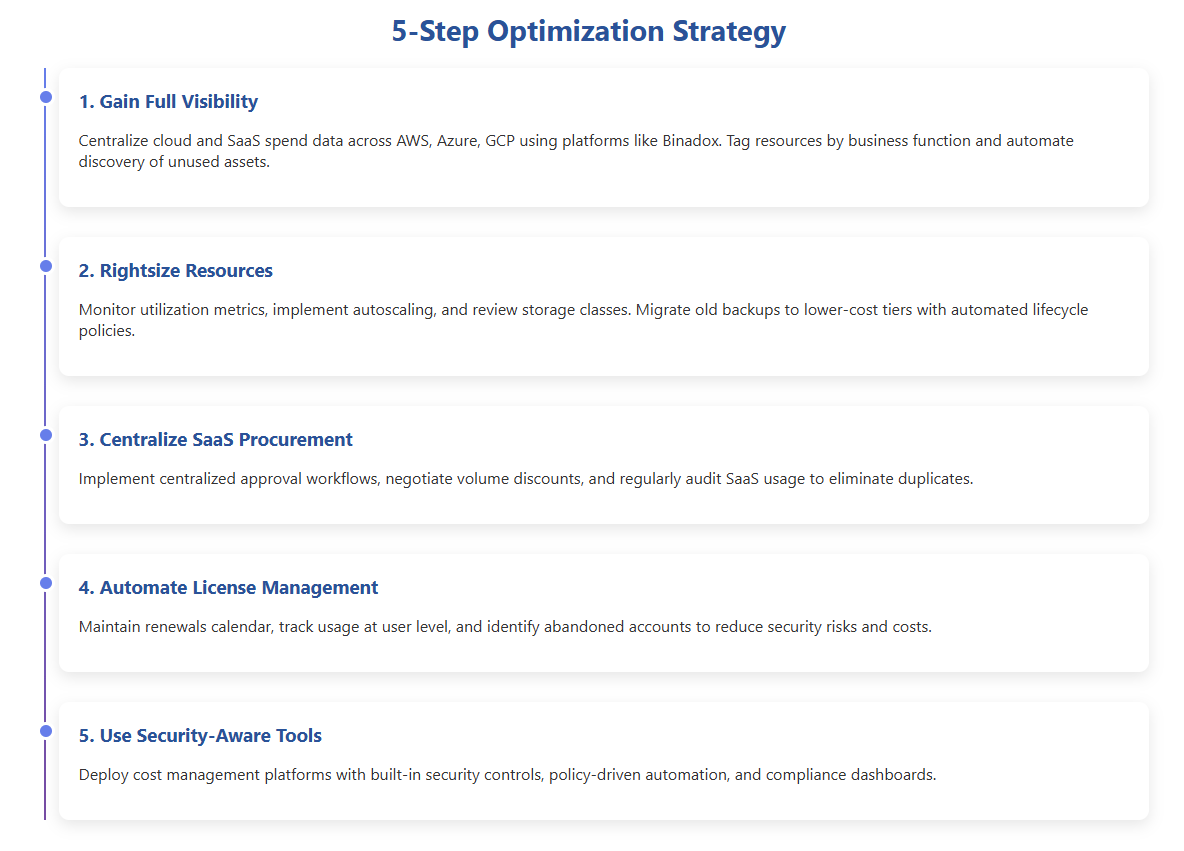

1. Gain Full Visibility Across Multi-Cloud and SaaS Environments

You can’t optimize what you can’t see. Fintechs should:

- Centralize Cloud and SaaS Spend Data: Use cloud management platforms like Binadox to aggregate usage and cost data across AWS, Azure, GCP, and SaaS providers in one dashboard.

- Tag Resources by Business Function: Consistent tagging (e.g., “Regulatory,” “R&D,” “Customer Service”) helps attribute spend to products or teams, exposing inefficient resource use.

- Automate Discovery of Unused Assets: Identify orphaned storage, idle VMs, and abandoned SaaS licenses that can be safely retired.

For a deeper look at the terminology and key concepts in cloud cost management, check out Binadox’s Basic Cloud Computing Terminology.

2. Rightsize Resources and Automate Scaling

Over-provisioning is a costly but common habit, especially in regulated industries where downtime is unacceptable. Solutions include:

- Monitor Utilization: Use real-time metrics to compare provisioned vs. actual usage; downgrade or terminate underutilized instances.

- Automate Scaling: Implement autoscaling for compute and storage to match demand while avoiding manual “buffer” allocations.

- Review Storage Classes: Migrate old backups and logs to lower-cost, compliant storage tiers, and automate lifecycle policies.

Binadox can identify these optimization opportunities and recommend specific actions based on real usage patterns.

3. Centralize and Streamline SaaS Procurement

Decentralized SaaS purchasing creates waste and hidden security risks:

- Implement a Centralized Procurement Workflow: Require business units to go through a central approval process for new SaaS subscriptions.

- Negotiate Volume Discounts: Consolidate licenses to gain leverage with vendors and cut costs.

- Audit SaaS Usage Regularly: Identify duplicate tools, unused licenses, and features that can be downgraded or canceled.

4. Automate Renewals and License Management

Missed renewals or unused auto-renewed subscriptions can be a silent budget killer:

- Maintain a Renewals Calendar: Platforms like Binadox provide a centralized calendar and alerts for all upcoming SaaS and cloud renewals.

- Track Usage at the User Level: Monitor who’s using which licenses and identify abandoned accounts or over-provisioned users.

This not only slashes costs but reduces the risk of security breaches from dormant, forgotten accounts.

5. Leverage Cloud Cost Management Tools with Built-in Security Controls

Select tools that don’t just show spend, but also flag security and compliance issues in real time:

- Policy-Driven Automation: Set up automated rules to de-provision resources, but only if compliance criteria are met (e.g., data retention policies are satisfied).

- Anomaly Detection: Use cost anomaly detection to spot unexpected spikes that could indicate either wasted spend or security incidents (e.g., crypto-mining attacks).

- Compliance Dashboards: Ensure all cloud and SaaS usage is mapped to required certifications and controls.

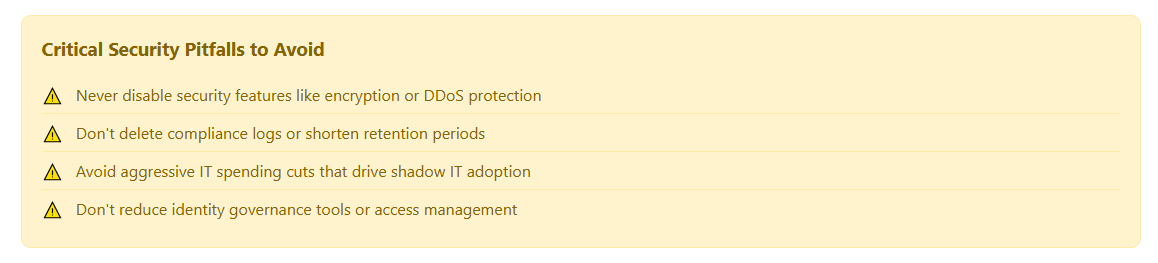

Common Security Pitfalls During Cloud Cost Optimization

1. Weakening Security Configurations

Disabling security features like encryption or DDoS protection to save costs is never worth the risk—especially when customer funds and sensitive financial data are at stake.

2. Neglecting Compliance Logging

Deleting or shortening retention for logs and backups to reduce storage bills can put you out of compliance with regulations like PCI DSS, SOX, or GDPR.

3. Ignoring Shadow IT

When IT clamps down too hard on spend, teams may start using unsanctioned cloud services, opening the door to data breaches and compliance violations.

4. Lax Identity and Access Management

Reducing spend by cutting identity governance tools or not enforcing least-privilege access can make it easier for attackers to move laterally in your environment.

Advanced Tactics: Getting Even More from Your Cloud

1. Adopt FinOps Best Practices

FinOps—the intersection of finance, operations, and engineering—is gaining traction among leading fintechs. Core principles include:

- Collaboration: Finance, engineering, and security teams must collaborate on cloud governance.

- Continuous Improvement: Establish regular cost reviews, not just one-off audits.

- Cost Allocation: Showback and chargeback models help teams understand their consumption and incentivize better behavior.

2. Use AI and Automation to Optimize in Real Time

AI-powered analytics and recommendation engines, like those found in Binadox, can:

- Automatically identify cost-saving opportunities

- Suggest security and compliance improvements

- Flag anomalous spend patterns for investigation

This allows teams to act quickly, preventing both overspend and security incidents.

3. Embrace Vertical-Specific Solutions

Many cloud vendors now offer fintech-specific solutions with built-in compliance controls. Evaluate these options for regulated workloads—they may cost more per unit but save time and reduce risk overall.

4. Harness the Power of Edge Computing (Where Applicable)

Some fintechs benefit from processing data closer to the customer (e.g., payment terminals or IoT devices) via edge computing. This can reduce cloud egress costs and improve latency, but requires careful security planning.

The Role of Cloud Cost Management Platforms

Centralized tools are critical for modern fintechs to control spend and secure operations. For example, Binadox provides:

- Unified Dashboards: See all cloud and SaaS spend in one place, broken down by team, region, or project.

- Renewals Calendar & License Management: Avoid surprise renewals and maximize usage of every license.

- Smart Recommendations: AI-powered suggestions to cut waste while maintaining compliance.

- Anomaly Detection: Automatic alerts for cost spikes or suspicious usage patterns.

- Compliance Reporting: Track controls, retention, and audit trails to prove regulatory compliance.

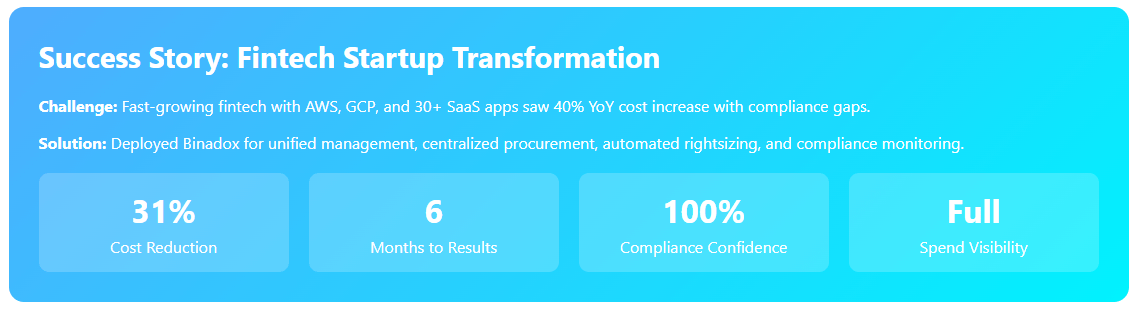

Case Study: A Fintech Startup’s Journey to Leaner, Safer Cloud Spend

Background:

A fast-growing fintech startup used AWS, GCP, and over 30 SaaS apps for payments, analytics, and customer support. Cloud costs soared 40% YoY, and audits revealed gaps in license management, compliance logging, and access controls.

Actions Taken:

- Deployed Binadox to aggregate and analyze all cloud and SaaS spend.

- Centralized SaaS procurement, consolidating duplicate licenses and negotiating better rates.

- Automated rightsizing for cloud compute and storage, cutting waste by 27%.

- Set up compliance and security policies to ensure logs were retained per PCI DSS.

- Implemented automated renewal tracking and user-level license audits.

Results:

- Reduced cloud and SaaS spend by 31% in six months.

- Increased confidence in compliance posture and reduced the risk of security incidents.

- Gained granular visibility into spend by product line, enabling data-driven investment decisions.

The Future: Keeping Costs Down as You Scale

Fintech is a fiercely competitive space, where every dollar saved can be reinvested in growth or innovation. Yet, security and compliance cannot be compromised. The good news? With the right processes and tools, these goals reinforce each other.

Checklist for Success:

- Visibility: Aggregate spend data across cloud and SaaS.

- Optimization: Rightsize, automate, and eliminate waste.

- Security: Never disable or bypass essential controls.

- Automation: Let AI-powered platforms like Binadox surface savings and risks in real time.

- Governance: Implement policies to manage procurement, usage, and renewals centrally.

For a practical, hands-on approach, start a Binadox free trial and see how much you can save—without sacrificing the security and compliance your fintech customers demand.

Conclusion

Fintech companies can absolutely slash cloud spend without sacrificing security. The keys are full visibility, automation, continuous optimization, and a culture of compliance. By leveraging dedicated cost management platforms like Binadox, fintech leaders can achieve operational efficiency, maintain trust, and fuel the next wave of financial innovation—all while staying lean and secure.